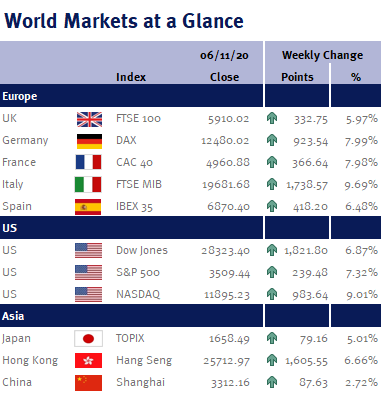

The big winner this week has been global equity markets.

Although as we write (Friday 6 November 2020) votes are still being counted in the few remaining key battleground states (Arizona, Georgia, Nevada and Pennsylvania), it appears that Joe Biden (a Democrat) is closing in on a victory over President Donald Trump (a Republican).

Although Joe Biden’s Presidential election is not a surprise, equity markets had expected the Democrats to gain control of the Senate.

However, not only does it look as though the Republicans will maintain a slim Senate majority, they have also reduced the Democrats’ advantage in the House of Representatives.

While the Presidential election understandably gets all the news headlines, from a market perspective the control of the Senate is more important – and the prospect of a split Congress reduces the influence of the new President.

In fact, we believe this is a goldilocks result: not only will we have less Twitter posts to keep us up at night, but more importantly a Republican Senate will ensure the danger from Joe Biden’s proposed tax increases on companies and individuals are blocked and his plans for tougher regulation and antitrust scrutiny are now likely to be far less troublesome.

We see the only negative being the eventual size of the new fiscal stimulus package – as this is now likely to be smaller than the one the Democrats ($2tr+) had been proposing (although positively, a smaller fiscal stimulus package will mean US monetary policy will stay looser for even longer).

Equity market sentiment this week was also helped by some very strong economic data. In addition to the US ISM and Eurozone PMI data we highlighted in the mid-week update (please see here), today’s US employment data was also much stronger than the major economists had expected: non-farm payrolls grew by 638,000, while private payrolls rose by 906,000. As a result, the unemployment rate fell from 7.9% to 6.9% (economists had expected 7.6%). Furthermore, the average weekly hours worked increased to 34.8.

In the UK, the BoE aggressively increased its QE (asset purchases) program by £150bn. Although policymakers left interest rates unchanged at 0.1%, given the new coronavirus lockdowns (and the potential for a negative hit to the economic recovery), we believe it is only a matter of time before we see negative interest rates.

Looking ahead to this coming week fingers-crossed we will see the back of the US Presidential election as we have plenty of economic data to focus on. Of main interest will be US and Chinese CPI inflation; US weekly jobless claims; the University of Michigan consumer sentiment index; UK industrial and manufacturing; and UK employment data.

Investment Management Team