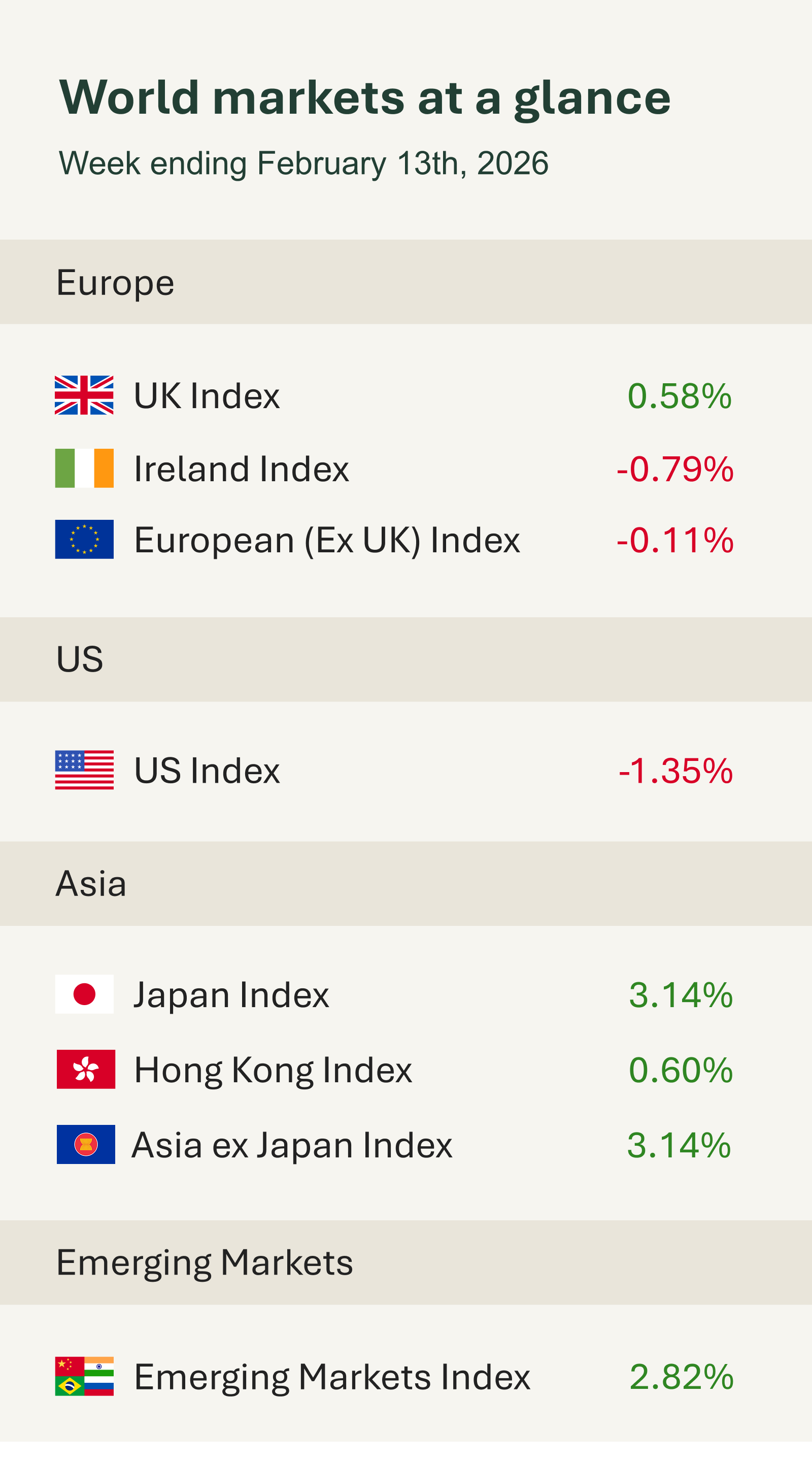

There was a substantial amount of economic data for markets to absorb this week. Overall, global market performance was mixed: US equities declined amid concerns around the potential disruption caused by rapid advances in AI, while the UK, Europe, and markets across Asia and emerging economies fared comparatively better.

A delayed batch of U.S. labour market data was released mid-week, prompting only a muted reaction from equity markets.

The data showed that job growth accelerated in January, reinforcing signs of labour market stability. Nonfarm payrolls increased by 130,000, following a downwardly revised gain of 48,000 in December. Meanwhile, the unemployment rate declined from 4.4% to 4.3%. Overall, the figures suggest the labour market remains on solid footing. This resilience gives the Federal Reserve flexibility to keep interest rates unchanged in the near term while policymakers continue monitoring inflation trends.

On the inflation front, January’s Consumer Price Index (CPI) report indicated further moderation. Annual headline inflation slowed to 2.4%, down from 2.7% in each of the previous two months and below consensus forecasts. The deceleration was partly driven by base effects, as stronger readings from a year ago dropped out of the annual calculation, as well as a notable decline in energy prices.

Core inflation, which excludes food and energy, edged down to 2.5% from 2.6% in December, in line with expectations. It is important to note that this represents only one month of data. However, if the current trajectory continues, it will support a path toward lower interest rates alongside gradually easing inflation pressures.

Markets edged lower late in the week as investors assessed the rapid pace of advancement in artificial intelligence. Some near-term uncertainty is natural as markets adjust to transformative technologies, but the long-term outlook for AI remains compelling. While short term volatility is inevitable, our diversified approach helps to mitigate its impact. By spreading investments across sectors and regions, our portfolios are not overly reliant on any one area, allowing us to navigate periods of short-term noise/disruption while remaining positioned to capture long-term opportunities.