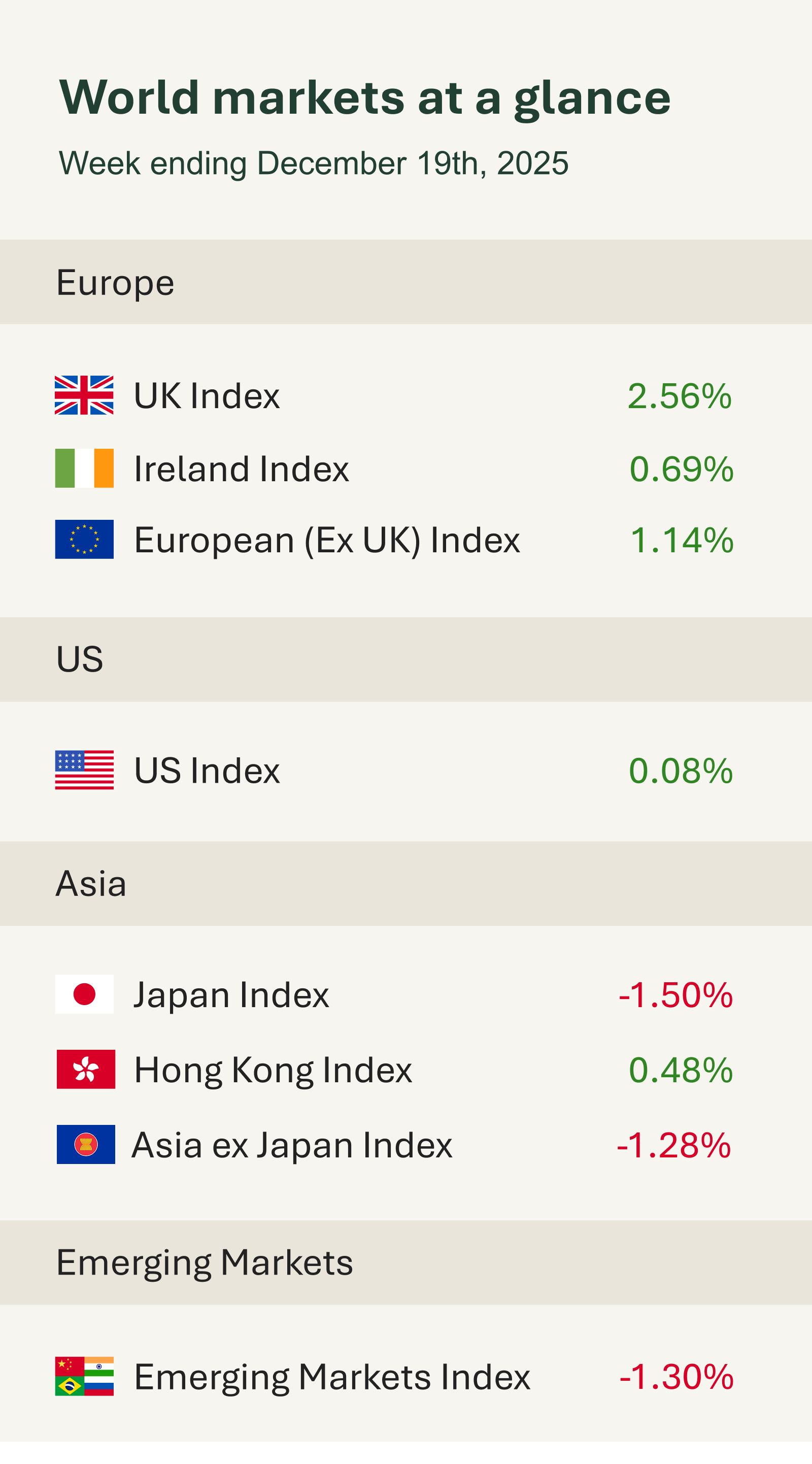

As you can see from the accompanying table, it was a broadly positive week for global financial markets and, for many, the final full trading week of 2025. Monetary policy dominated the headlines, particularly in the UK, where the Bank of England (BoE) delivered its closely watched December policy decision.

UK equities ended the week strongly positive, supported by signs that inflation is easing and interest rates may now be on a gentler downward trajectory. The BoE’s Monetary Policy Committee voted 5–4 to cut Bank Rate by 0.25% to 3.75%. The narrow margin shows that policymakers remain cautious: while the majority judged inflation to be easing, four members preferred to hold rates, reflecting concerns that inflation might not fall sustainably without restraint.

The decision came hot on the heels of UK inflation data which showed price growth slowed to 3.2% in November, below the Bank’s expectations. The softer print supported a market rally by tempering expectations that inflation will remain persistently elevated.

The BoE aims to bring inflation back to a sustainable 2%. The committee signalled that policy is now close to what it considers a ‘neutral’ rate, one that neither stimulates nor slows the economy though opinions on that level differ. Uncertainty over how quickly spare capacity will build, combined with short-term inflation-reducing fiscal measures in the recent Budget, means policymakers remain cautious.

Economic data in the UK painted a mixed picture. Retail sales fell 0.1% in November following a weak October. However, the data is often distorted by Black Friday discounting patterns, which makes interpretation difficult. Overall, it’s too early to call a meaningful downturn in consumer demand until December data is also released.

Market performance was uneven early in the week, reflecting a continuation of the prior week’s tech‑sector weakness amid persistent concerns over AI‑related valuations and spending. However, equities ultimately finished the week on firmer footing. U.S. stocks reversed a four-day losing streak after inflation data showed softer-than-expected price pressures. The Consumer Price Index increased 2.7% year‑on‑year in November, moderating from the 3.0% pace recorded in September (October figures were unavailable due to data‑collection disruptions during the federal government shutdown). The softer inflation trajectory strengthened expectations that the Federal Reserve could extend its policy‑easing cycle into 2026, lifting market sentiment toward the end of the week.