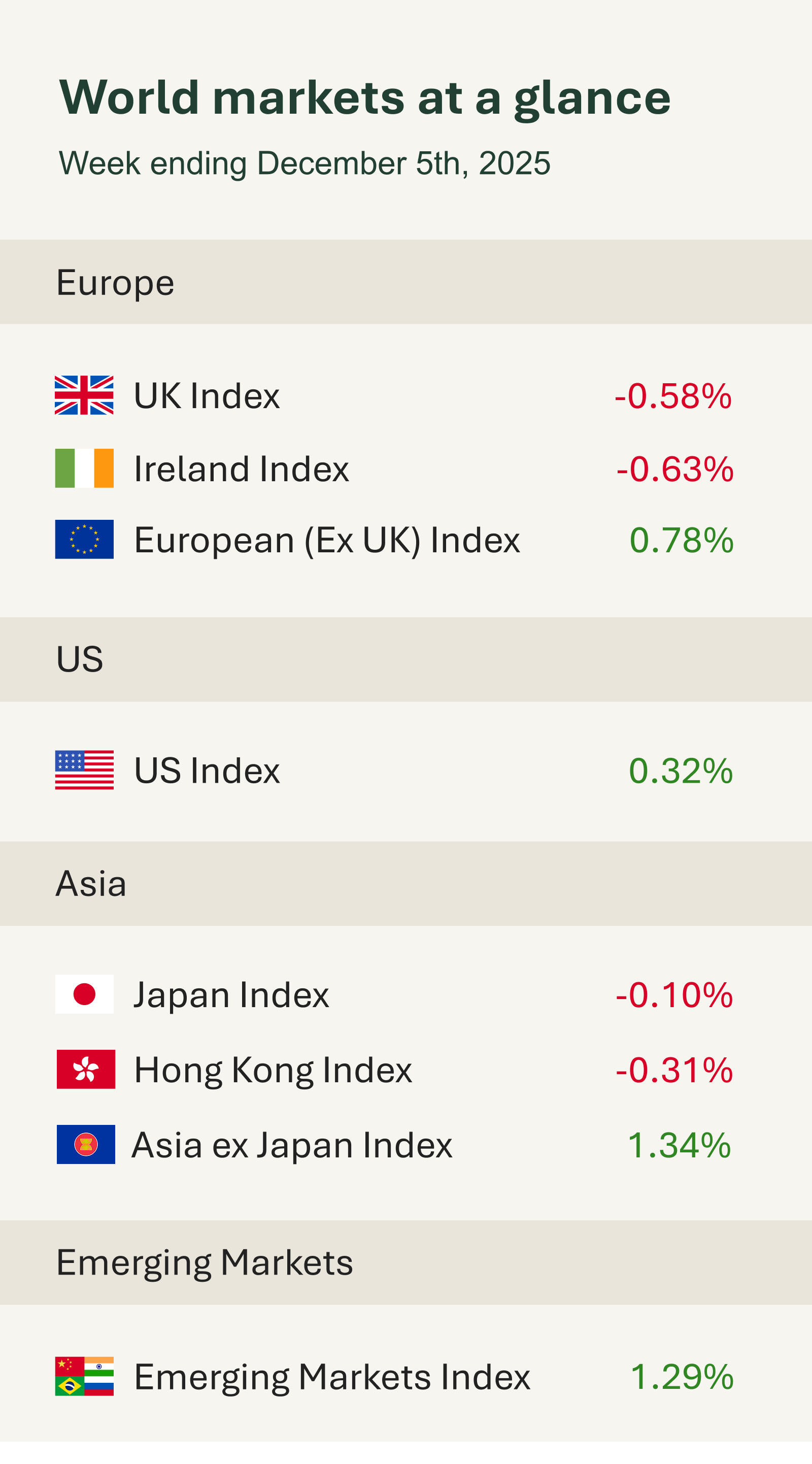

As you can see from the accompanying table, it was a mixed week; however, some financial markets eked out modest gains. Investors were reluctant to take strong positions ahead of a series of closely watched central bank decisions.

In the US, attention remained squarely on the Federal Reserve’s final policy meeting of the year, scheduled to conclude on Wednesday 10th December. Markets continued to add to expectations of an interest-rate cut, a shift supported by a fresh batch of softer labour-market indicators. Private payroll provider ADP reported that US companies shed 32,000 jobs in November, reversing the 47,000 positions added in October. The government’s official November employment report was delayed to 16th December due to the shutdown, leaving investors more reliant than usual on private data to gauge labour-market momentum. Weekly jobless claims offered a slightly more stable picture, declining to 191,000 for the final week of November, but the overall trend continues to point toward a cooling jobs market.

The Federal Reserve’s preferred inflation gauge, core PCE, rose 0.3% month on month in September, matching August’s increase, while the annual core rate eased marginally to 2.8% from 2.9%. Although still above the Fed’s long-term 2% goal, the moderation was enough to support the prevailing view that inflation is continuing to trend lower.

US Consumer sentiment also ticked up, with the University of Michigan’s preliminary December reading rising to 53.3 from 51.0 in November, suggesting that households may be stabilising after several months of weakening confidence.

In the most recent meetings committee members appeared divided on the timing and pace of future cuts, a factor that may keep market volatility subdued until clearer guidance emerges. Given the recent data, market futures are pricing a 87% probability of a 0.25% rate cut next week.

The headline news this week was Netflix’s announcement of its plan to acquire Warner Bros; Discovery’s film and television studios, along with its streaming assets, in a deal valued at approximately $82.7 billion. The landmark acquisition has sparked a wide range of reactions.

The UK also experienced a relatively muted week, with the FTSE 100 drifting 0.55% lower. The UK services PMI for November came in at 51.3, ahead of expectations for 50.5, signalling continued if tentative expansion in the country’s dominant sector. Yet underlying challenges persist. A Bank of England survey released on Thursday revealed that businesses cut jobs at the fastest pace in four years last month. Uncertainty ahead of Chancellor Reeves’s forthcoming budget was cited as a key factor weighing on corporate hiring and activity.