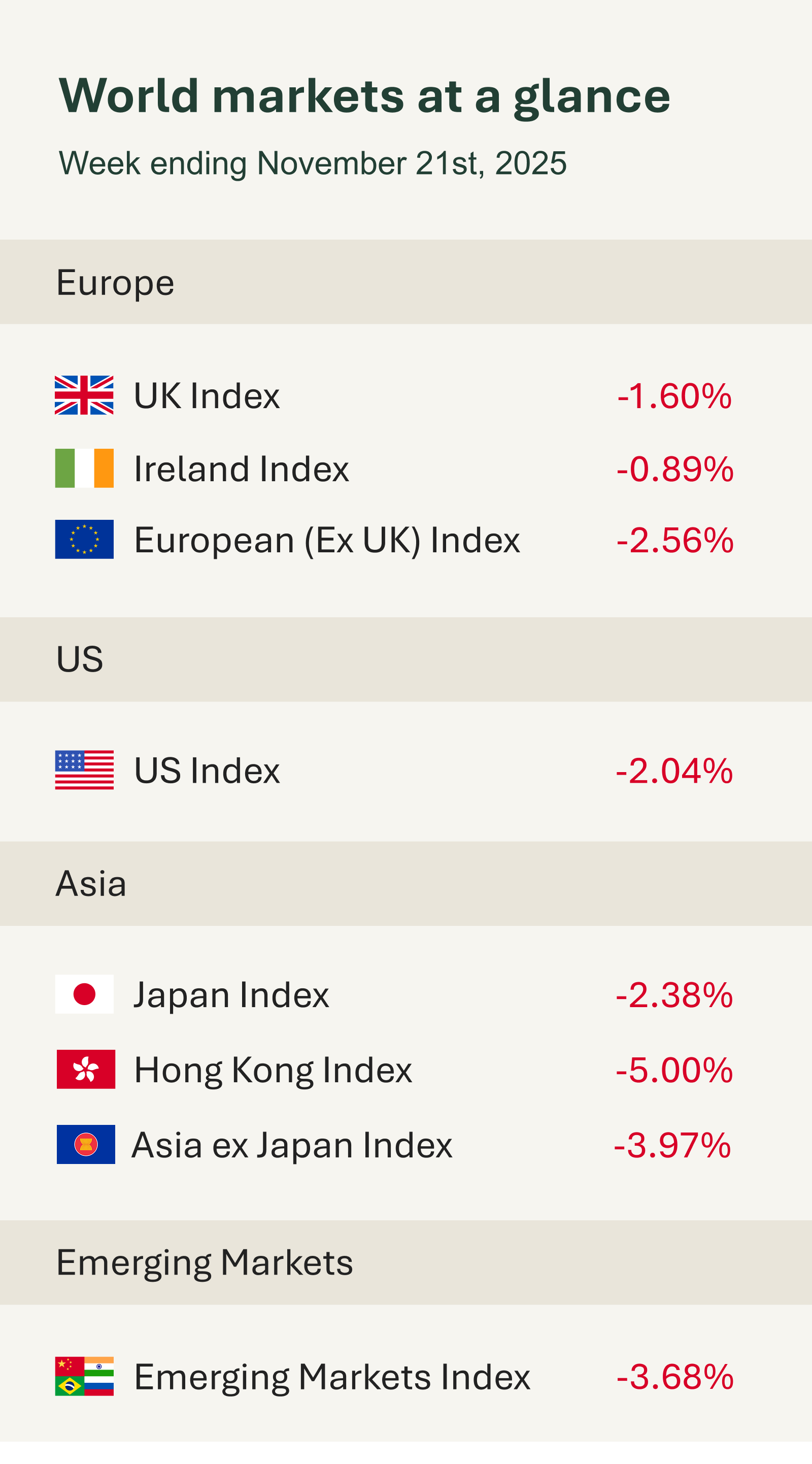

As you can see from the accompanying table, financial markets broadly closed the week in the red, despite positive corporate earnings and the resumed released of U.S. economic data. Concerns linger around lofty AI valuations and aggressive capital expenditure plans across the sector.

This week’s market narrative was dominated by Nvidia. With Nvidia now accounting for nearly 8% of the S&P 500, its performance often sets the tone for broader markets especially at a time when investors are questioning the durability of elevated tech valuations.

Nvidia delivered another robust set of results, easing immediate concerns of an AI bubble. The company reported a record 65% increase in profit and raised guidance for the current quarter. This strong outlook offered reassurance that demand for AI-related hardware remains firm. Shares initially rose 5% in extended trading, fuelling a strong rebound upon market open on Thursday.

However, in a swift reversal, major indices surrendered their intraday gains and closed sharply lower. The Nasdaq Composite, which had been up more than 2% earlier in the session, ended the day 2.2% lower, while Nvidia shares fell 3.2%, giving up their post-earnings pop. This earnings season, markets have been notably unforgiving, rewarding earnings reports that beat estimates less generously than usual and penalising misses more severely, even though out of 95% of S&P 500 companies that have reported, roughly 83% have exceeded expectations – an exceptionally strong showing.

It’s important to keep recent market volatility in perspective. Even after the recent pullback, the S&P 500 remains up over 30% (Total Return GBP) since its April tariff lows, and the Nasdaq Composite is up 44.6% over the same period. Against this backdrop, the recent movements appear to represent a healthy recalibration rather than the start of a more pronounced correction.

With fundamentals largely intact and the broader earnings picture remaining strong, the underlying market momentum continues to look resilient.

Concerns about whether the U.S. Federal Reserve will cut rates again before the end of the year also contributed to dampened sentiment. Economic data on the U.S. labour market was published for the first time since the government shutdown. The September jobs data, postponed due to the government shutdown, showed the U.S. added 119,000 positions, beating consensus forecasts for 50,000 jobs. However, the unemployment rate unexpectedly climbed from 4.3% to 4.4% in September, though the pickup was due in part to an increase in the labour force, which the BLS said gained 450,000 new potential workers.