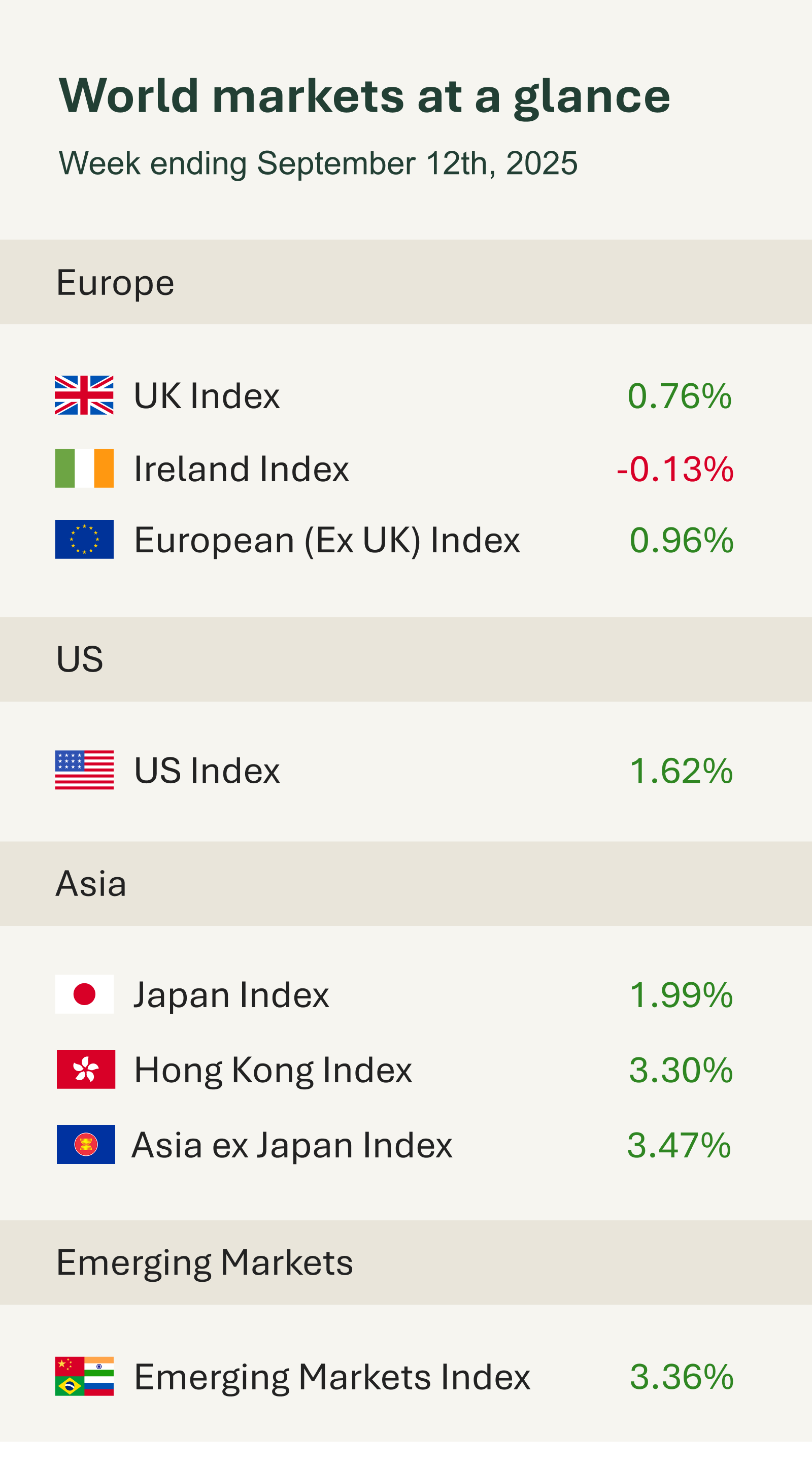

As you can see from the accompanying table, markets around the world moved higher this week as investors continued to position for looser U.S. monetary policy and looked past mixed economic signals. Notably, markets largely shrugged off geopolitical noise this week, focusing instead on domestic data.

Investor attention was firmly on August U.S. inflation data this week, with markets increasingly convinced that the Federal Reserve would cut rates at its next meeting on Wednesday 17th September. First up was Wednesday’s Producer Price Index (PPI) a report closely watched gauge that tracks the prices businesses pay for goods and services before they reach consumers. Wholesale prices unexpectedly fell 0.1% in August, against forecasts for a 0.3% rise. A relatively tame Consumer Price Index (CPI) print followed. Headline inflation rose to 2.9% year-on-year. Yet core readings which exclude volatile items such as food and energy held steady in line with previous months and expectations at 3.1% year on year.

Softer labour market data and downward payroll revisions reinforced the case for easing. While inflation remains above the 2% target, August’s readings are unlikely to stand in the way of the Federal Reserve lowering interest rates next week. Initial jobless claims surged by 27,000 in the week ending 6 September, far exceeding forecasts reinforcing signs that the labour market is losing momentum. For investors, the near-term outlook to a more accommodative Fed stance, which bodes well for both equity and bond markets. Inflation trends and policy signals will remain key drivers into year-end, and with ongoing uncertainty and the unknown impact of tariffs, next week may may prove to be the first and only rate cut of the year.

European equities wrapped up the week in positive territory, as investors looked past political upheaval in France to focus on broader economic signals. The surprise ousting of Prime Minister François Bayrou and swift appointment of Sébastien Lecornu sparked nationwide protests under the “Block Everything” movement, but markets remained resilient.

At its September meeting, the European Central Bank held interest rates steady, keeping the deposit rate at 2.00% as expected. While the ECB avoided committing to a specific rate path, it underscored a data-dependent approach and signalled flexibility should growth weaken or inflation ease. Notably, policymakers highlighted rising global risks including uncertainty around US tariff policy as a key factor in their cautious stance.

Investors have remained focused on broader macroeconomic trends, helping keep eurozone assets relatively stable despite political unrest in France and ongoing export concerns. In Germany, July exports declined by 0.6% due to weaker U.S. demand, while factory orders fell 2.9%, underscoring the region’s vulnerability to global trade pressures.