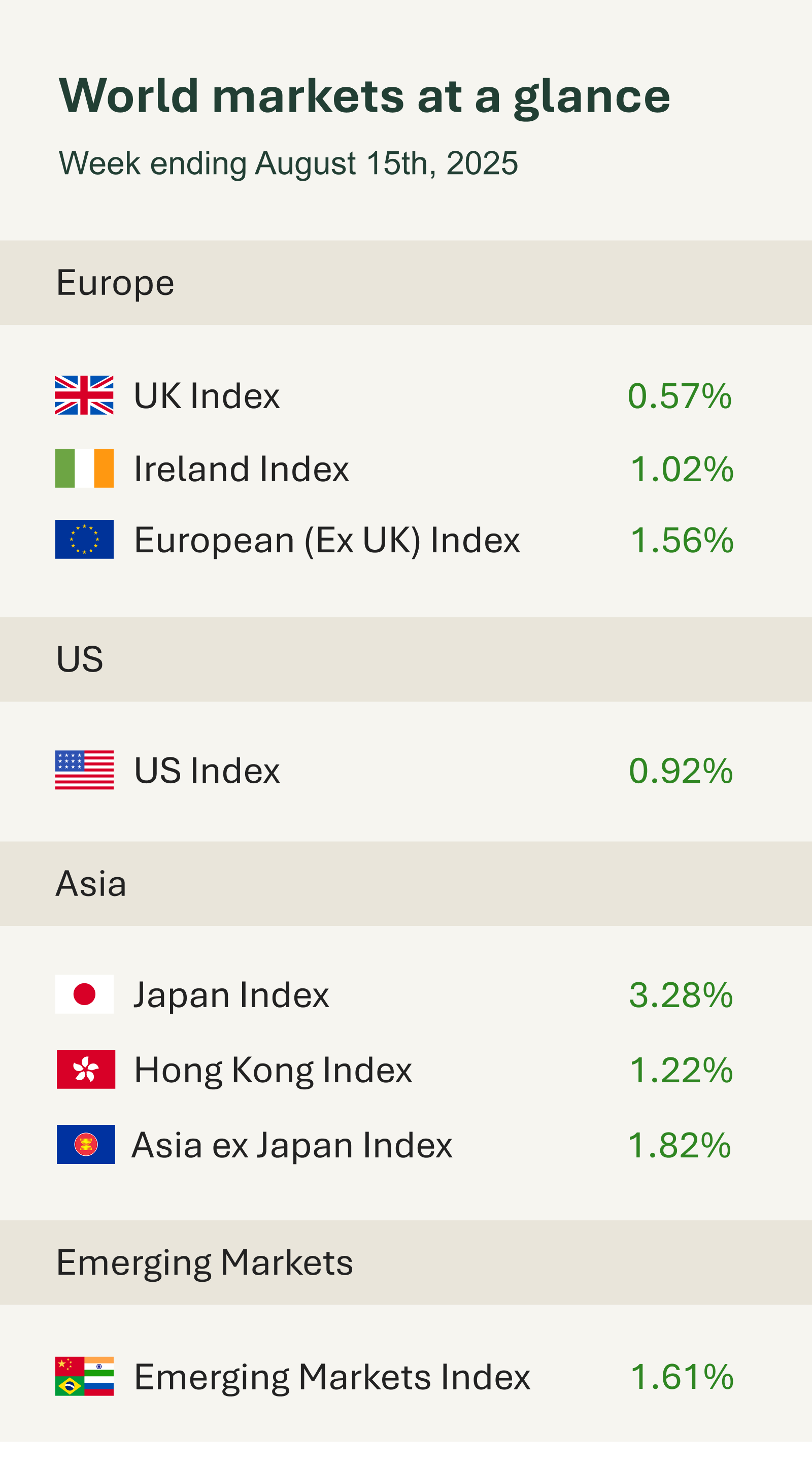

As you can see from the accompanying table it was another positive week for global equities. There was plenty of economic data for investors to digest as well as key geopolitical developments on Friday in the form of talks between the US and Russia in Alaska.

Data wise, UK economic growth slowed to 0.3% in the second quarter, as businesses felt the pinch from US President Donald Trump’s import tariffs and rising domestic costs. The latest economic growth figures mark a deceleration from the 0.7% growth seen in Q1, when firms rushed to front-load activity ahead of tariffs changes. Despite the slowdown, the result exceeded expectations of just 0.1% growth and was buoyed by a surprisingly strong June, with GDP rising 0.4% that month alone. The slowdown reflects caution from consumers and mounting pressure on employers, who faced higher national insurance contributions and increased minimum wages. With the autumn Budget approaching, attention now turns to Chancellor Rachel Reeves’ upcoming tax and spending decisions, which could shape the UK’s economic path for the rest of the year.

U.S. equities touched record highs earlier in the week after softer July Consumer Price Index (CPI) data reinforced expectations for Fed rate cuts, with little sign that tariffs were yet feeding into consumer prices. Later in the week, however, Producer Price Index (PPI) surprised sharply higher, rising 0.9% month-on-month in July and 3.3% year-on-year, the steepest gain in three years. The jump, driven by portfolio management fees and airfares, suggests businesses may be starting to pass on tariff-related costs. While traders largely viewed these pressures as temporary, fed funds futures still price in a September cut, though expectations for a larger 50bp move have faded.

PPI can offer an early signal on inflation trends the latest PPI came in stronger than expected, contrasting with relatively soft CPI figures, suggesting that businesses have so far absorbed much of the tariff-related costs rather than passing them on to consumers. However, this dynamic may be changing, with firms potentially beginning to pass those costs through, a development policymakers will be watching closely.

In other news, European markets climbed steadily throughout the week ahead of a high stakes meeting in Anchorage, Alaska on Friday between U.S. and Russian officials. The summit marks the first encounter in six years between Presidents Trump and Putin. Trump had aimed to secure a breakthrough ceasefire in the war in Ukraine, a pledge he made to fulfil within 24 hours of taking office but has yet to deliver. Ukrainian President Zelenskyy was excluded from the talks and warned that any agreements made without Ukraine’s involvement would lack legitimacy.