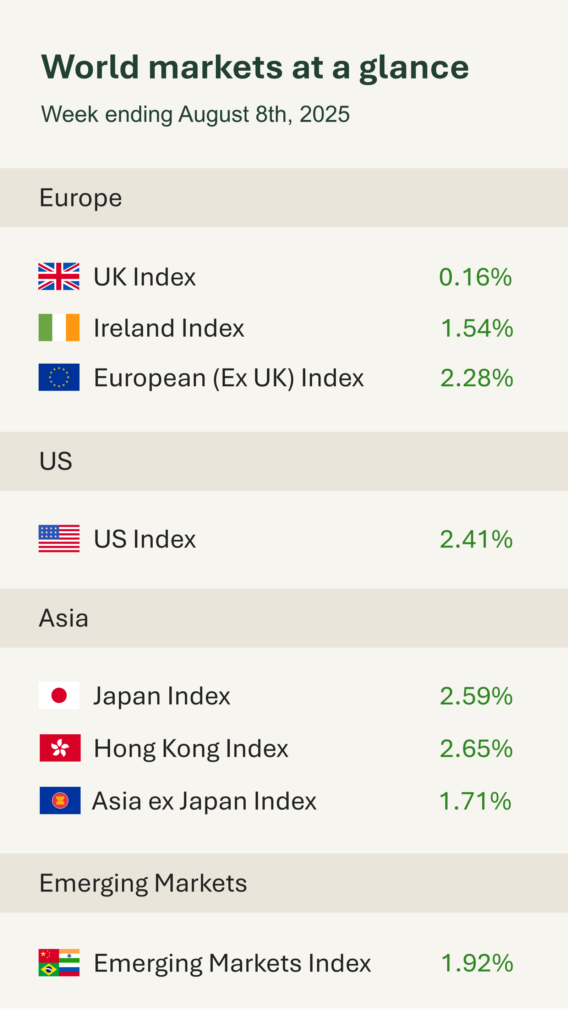

As you can see from the accompanying table markets closed the week on a strong note, buoyed by a weak US July jobs report, a surge in tech stocks, solid quarterly earnings, and optimism over potential progress in peace talks between Russia and Ukraine.

In the US, equities recovered from the prior week’s sell-off, led by the Nasdaq Composite, which hit a new record. Gains were driven in part by Apple shares, which rallied after the company pledged an additional $100bn toward US-based manufacturing on top of a previous $500bn commitment helping it avoid steep semiconductor tariffs.

The market reaction to President Donald Trump’s latest tariffs was muted. The measures, which took effect Thursday, were largely anticipated, with major trade deals already in place. Trump also doubled tariffs on India to 50% in response to its Russian oil purchases (effective 27 August) and maintained 39% tariffs on Switzerland after negotiations failed. Investors appear increasingly indifferent to tariff developments, or confident any economic fallout will be contained.

In the UK, the Bank of England cut interest rates to 4% the lowest level in over two years in an effort to support growth as inflationary pressures ease. The widely expected move marked the fifth cut since last August, though the Monetary Policy Committee was split, with five members in favour, four against, and one advocating for a larger 0.5% cut. While inflation remains above target, the Bank cited signs of disinflation as last year’s energy price surge fades. Governor Andrew Bailey struck a hawkish tone, stressing that any further cuts will depend on the inflation outlook. Lower interest rates reduce borrowing costs on mortgages, loans, and credit cards, easing financial pressure and making homeownership more attainable. With smaller repayments, households often have more disposable income, which can boost spending and help stimulate the economy. This often creates a supportive backdrop for equity markets, as stronger consumer demand and reduced corporate financing costs tend to bolster earnings, which can, in turn lift share prices

European stocks ticked higher late in the week amid growing optimism over diplomatic efforts between Russia and Ukraine. President Donald Trump reported “very good talks” with Russian President Vladimir Putin and hinted at a possible meeting, while media sources suggested he was working to arrange a joint discussion with Ukrainian President Volodymyr Zelenskyy. The main event on Friday will be a scheduled meeting between Trump and Putin in Alaska, where hopes for a truce are expected to take centre stage. Trump has floated the idea of “some swapping of territories” as part of a potential resolution an approach that Zelenskyy has firmly contested.