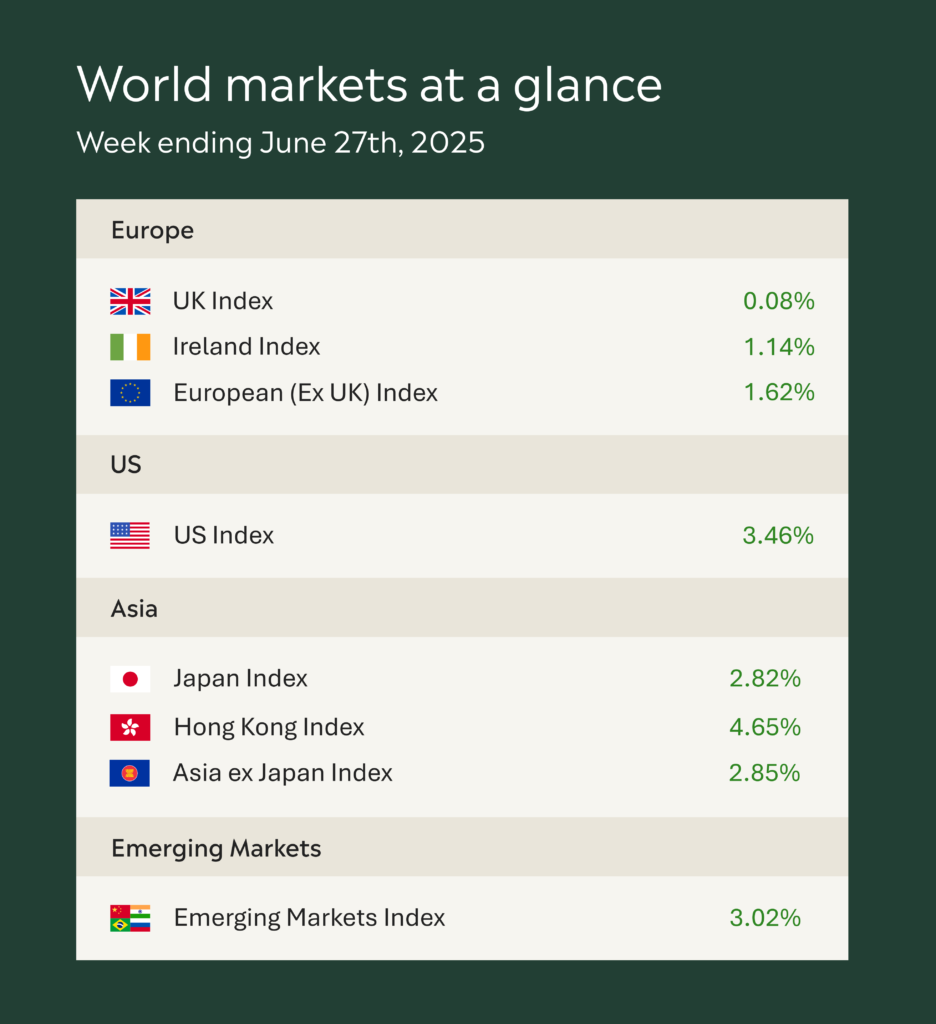

As you can see from the accompanying table financial markets wrapped up the week on a positive note and in some cases hit record highs.

Markets were lifted by a wave of optimism following news that the US and China have officially signed a trade agreement. While details remain light, reports suggest the deal includes progress on tech restrictions and rare earth exports. That was enough for investors, who welcomed signs that the world’s two largest economies are finding common ground after weeks of tension. Sentiment was further boosted after Donald Trump hinted at a possible separate agreement with India that could “open up” trade between the two nations. However, stocks pulled back from session highs after Trump said he was abandoning trade talks with Canada.

In the US, equity markets surged. The S&P 500 climbed 3.44% and the Nasdaq rose an impressive 4.25%, both closing at record highs. Market sentiment was further buoyed by dovish remarks from several Federal Reserve officials, indicating rate cuts could be on the table sooner than many have been anticipating.

US data showed the Fed’s preferred inflation gauge, the personal consumption expenditures (PCE) price index, ticked slightly higher in May, rising 0.1% for the month and 2.3% year on year. The core PCE, which strips out food and energy, came in at 0.2% monthly and 2.7% annually, both a touch higher than forecast. While inflation remains above target, the modest increases are unlikely to shift the Fed’s policy stance dramatically in the near term.