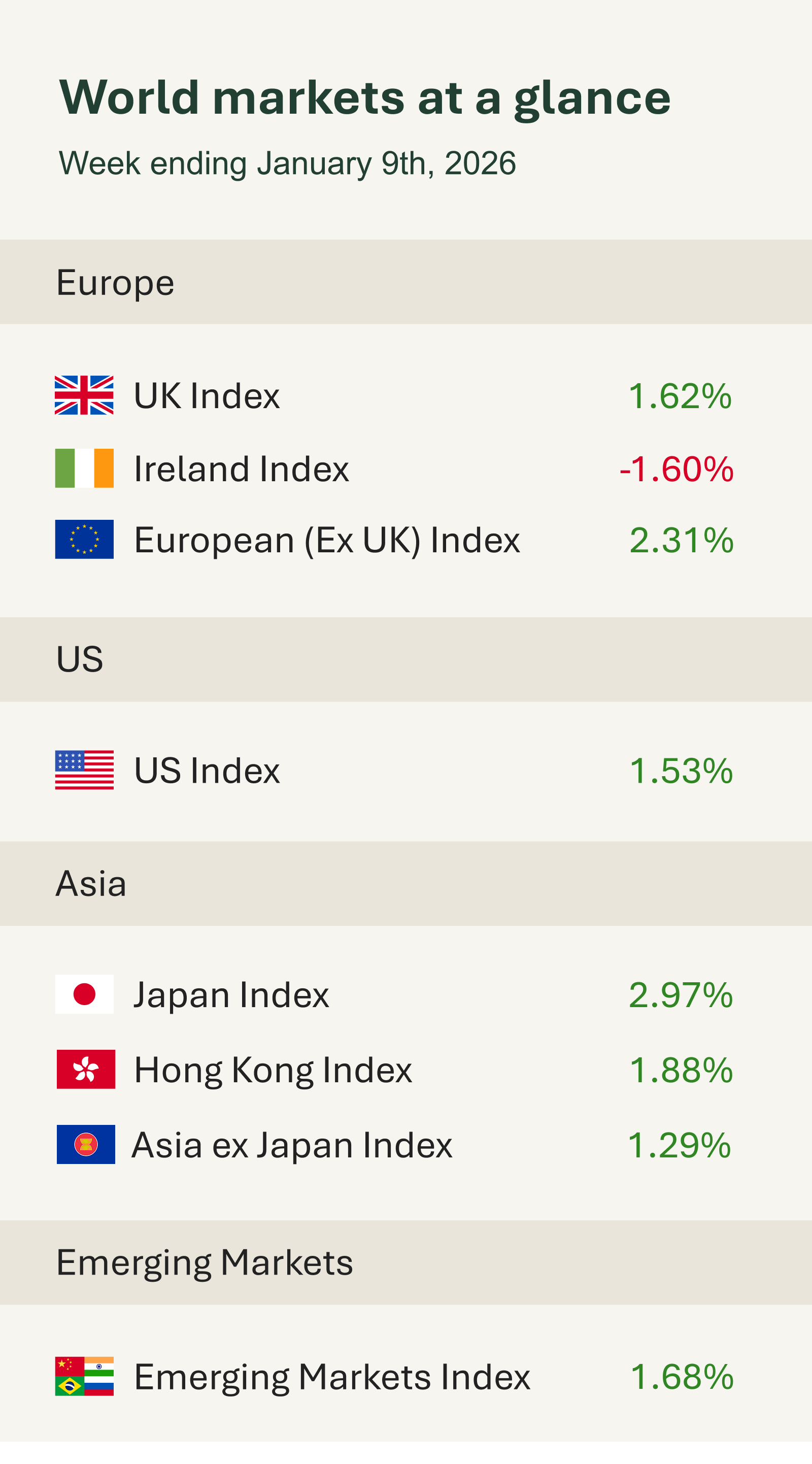

As shown in the accompanying table, markets mostly enjoyed a positive end to the week’s trading session.

This week in China, headline CPI for December rose 0.8% year-on-year, while core inflation – excluding volatile categories such as food and energy – held at 1.2%. Although core inflation reached its highest level in 20 months, it remains below policymakers’ 2% target, suggesting that underlying price pressures are still relatively subdued. Throughout 2025, China faced weaker consumer demand, partly driven by ongoing tariff discussions and compounded by prolonged challenges in the property sector, which have weighed on household confidence and savings. Looking ahead, China is currently projected to achieve growth of around 4.8% in 2026, with consensus expectations pointing to further government support for demand – potentially through additional consumer discounts, spending incentives, or further rate cuts as the year progresses.

Last month, U.S. employers created roughly 50,000 new positions, according to figures released Friday by the Bureau of Labor Statistics. That marks the slowest pace of hiring seen since the height of the pandemic. In addition, previously published numbers for October and November were adjusted downward and the unemployment rate slipped moderately to 4.4% from 4.5% the month before. These developments will factor into the Federal Reserve’s upcoming discussions when policymakers gather at the end of January, when they’ll look to decide whether to trim interest rates (currently set between 3.5% and 3.75%) or leave them unchanged. Even though the latest employment update fell short of expectations, it didn’t unsettle financial markets. Major stock indexes in both the United States and Europe ended the day higher, with some economists suggesting that investors seem to simply be brushing off economic headlines as the year starts out.

This week, Donald Trump invoked emergency powers to block roughly $2.5 billion in Venezuelan oil income held in U.S. government accounts, aiming to stop private creditors from claiming it. Signed late Friday, the order asserts that losing control of these funds would undermine U.S. strategic interests and regional stability and is part of a broader push to guide Venezuela’s economy after Nicolás Maduro’s capture. Trump also urged major American oil companies to invest in rebuilding Venezuela’s energy sector, promising that they would deal directly with the U.S. rather than Venezuelan authorities.

In the same event, Trump announced that the U.S. would do something about Greenland regardless of authorities’ feelings on the matter but did indicate that he was open to talks with leaders of the region. The comments regarding Greenland have been positioned as a matter of national security by Trump but have been disputed by many regions across Europe, with many economists also viewing the comments as a form of posturing by the President owing to the many considerable political, legal and alliance-related obstacles currently in his path that would block him from taking control of the country.

Still to come next week we have U.S. CPI, PPI and retail sales and Eurozone balance of trade.