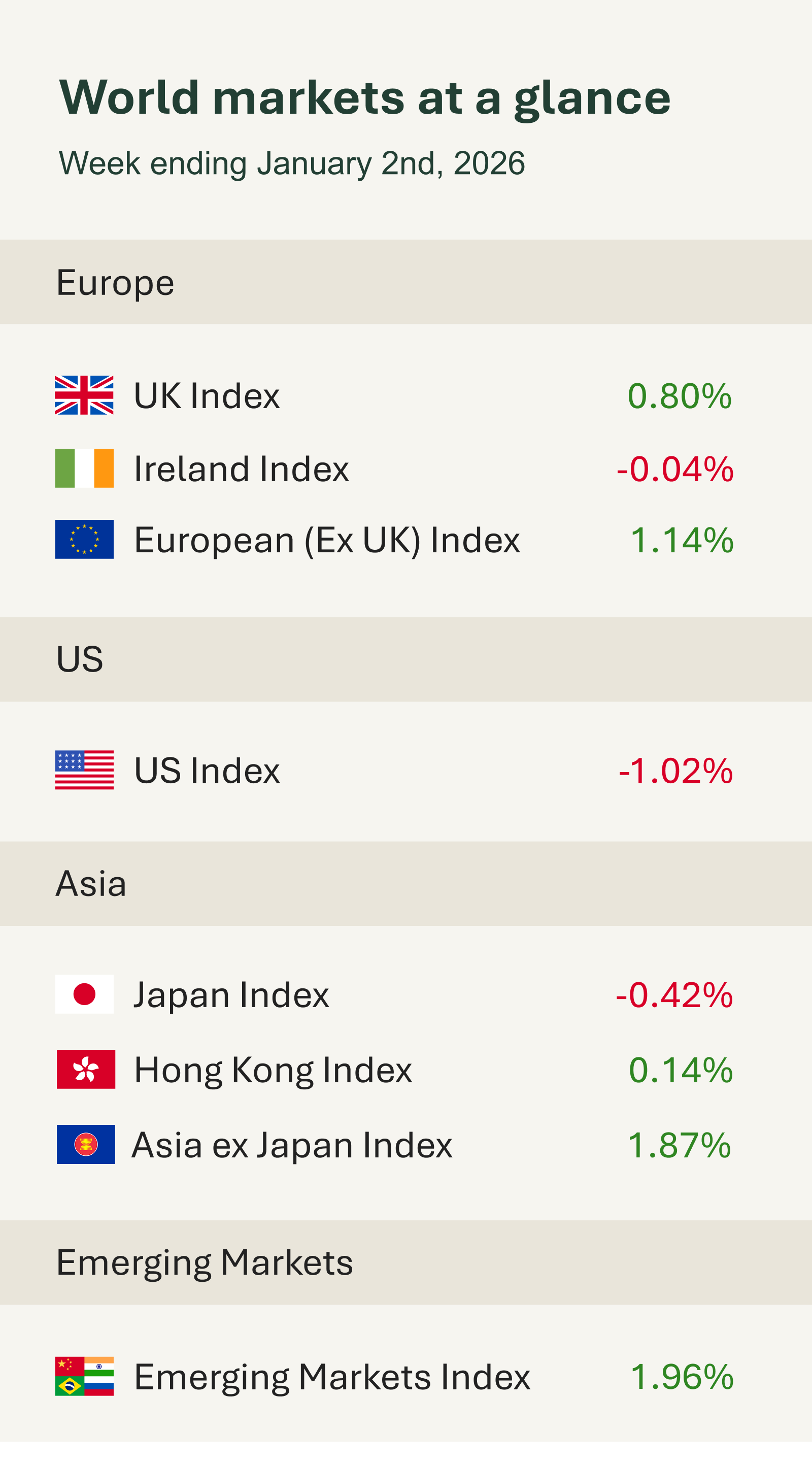

Trading volumes were thin over the Christmas and New Year period, with many major exchanges closed or operating on reduced hours. As a result, market activity was subdued, and price moves were generally modest.

Looking back, 2025 proved to be an exceptionally strong year for financial markets, despite several bouts of volatility along the way. Global equities delivered robust gains, with the FTSE All World Index rising close to 15% on a total return basis in sterling terms.

For UK investors in particular, the year stood out. The FTSE 100 recorded its best annual performance since 2009. Our portfolios have delivered double-digit returns, underlining the benefits of diversification and long-term discipline. Despite persistent geopolitical noise throughout the year and the shock back in April surrounding “Liberation Day”, markets recovered quickly and finished the year higher – an important reminder of the value of staying invested and not reacting to short-term market turbulence.

On the macro front, economic data releases were relatively quiet. Investor attention focused mainly on China’s PMI data and the minutes from the Federal Reserve’s December policy meeting.

Data from China’s manufacturing sector returned to growth toward the end of the year. The official manufacturing PMI rose to 50.1 in December from 49.2 previously, moving back into expansionary territory. Policy developments in China drew attention as well. Authorities reportedly instructed chipmakers to source at least 50% of equipment for new capacity from domestic suppliers, reinforcing efforts to achieve semiconductor self-sufficiency. In addition, Beijing announced measures to support domestic demand, including a VAT cut on homes sold within two years and an initial $9 billion allocation for consumer subsidies in 2026, aimed at stabilising consumption and underpinning growth.