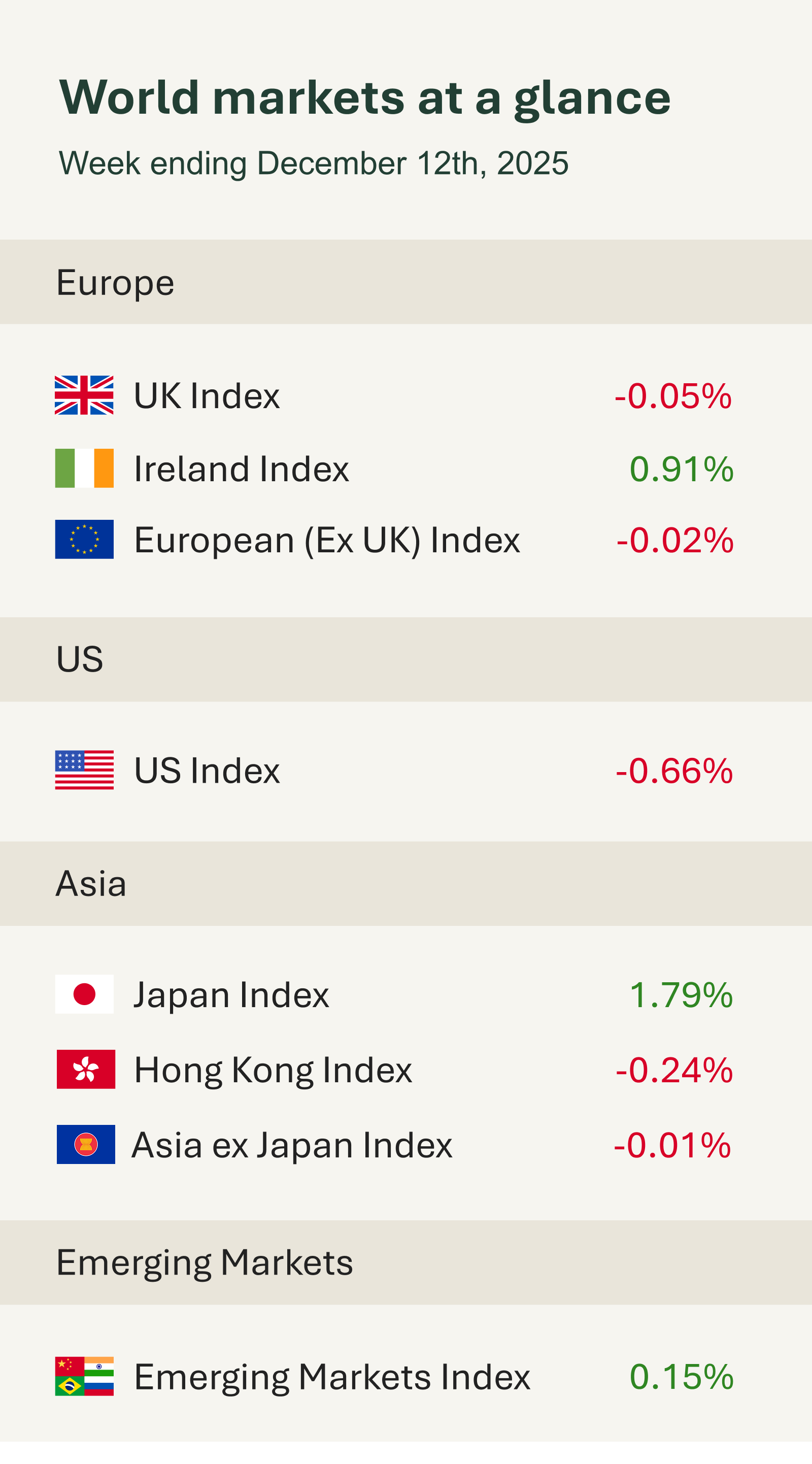

As the accompanying table shows, it was a mixed week for financial markets, as investors navigated a mix of central bank decisions, earnings surprises and economic data.

On Wednesday 10th December the U.S. Federal Reserve lowered interest rates by 25 basis points to a range of 3.5%–3.75%. This marked the third consecutive cut, following similar moves in September and October.

Policymakers signalled that rates are likely to remain on hold until clearer evidence emerges on inflation and labour market trends, both of which remain finely balanced. Fed Chair Jerome Powell avoided offering forward guidance, instead emphasising the risk of undermining job creation if policy is loosened too aggressively. With inflation still above target, the Fed’s dual mandate of price stability and full employment continues to drive internal debate. Powell noted that the Fed funds rate is “within a broad range of estimates of its neutral value” and that policymakers are “well positioned to wait and see how the economy evolves”.

Futures markets are currently pricing in two further 25-basis-point cuts in 2026, which would take rates closer to 3.0%. By contrast, the Fed’s own projections imply a slower path, with just one cut next year and another in 2027.

Still, Wednesday’s move offered reassurance. Powell’s less hawkish tone helped calm nerves, and U.S. equities extended gains, reaching record highs by Thursday.

However, gains proved short‑lived as the AI trade faltered as investors were disappointed by reports from Oracle and Broadcom. The S&P 500 and Nasdaq ended the week lower, though the Dow advanced. Oracle shares slid after weaker second‑quarter results and higher investment spending, while Broadcom beat revenue forecasts, issued strong guidance, and highlighted its role in AI infrastructure. Even so, its stock fell in after‑hours trading, underscoring investors’ increasingly demanding expectations for AI growth. Both updates point to companies investing heavily in future opportunities, even as markets press for quicker returns.

In the UK, economic data reinforced concerns about a fragile recovery. GDP contracted by 0.1% in October 2025, with activity slowing across several key sectors in the run-up to Chancellor Rachel Reeves’ Autumn Budget. While manufacturing saw a temporary boost from Jaguar Land Rover’s return to production, pre-Budget uncertainty weighed on business confidence and investment. The weakness has strengthened expectations that the Bank of England will cut interest rates, with markets now viewing a move to 3.75% at the Monetary Policy Committee meeting on 18th December as all but certain.