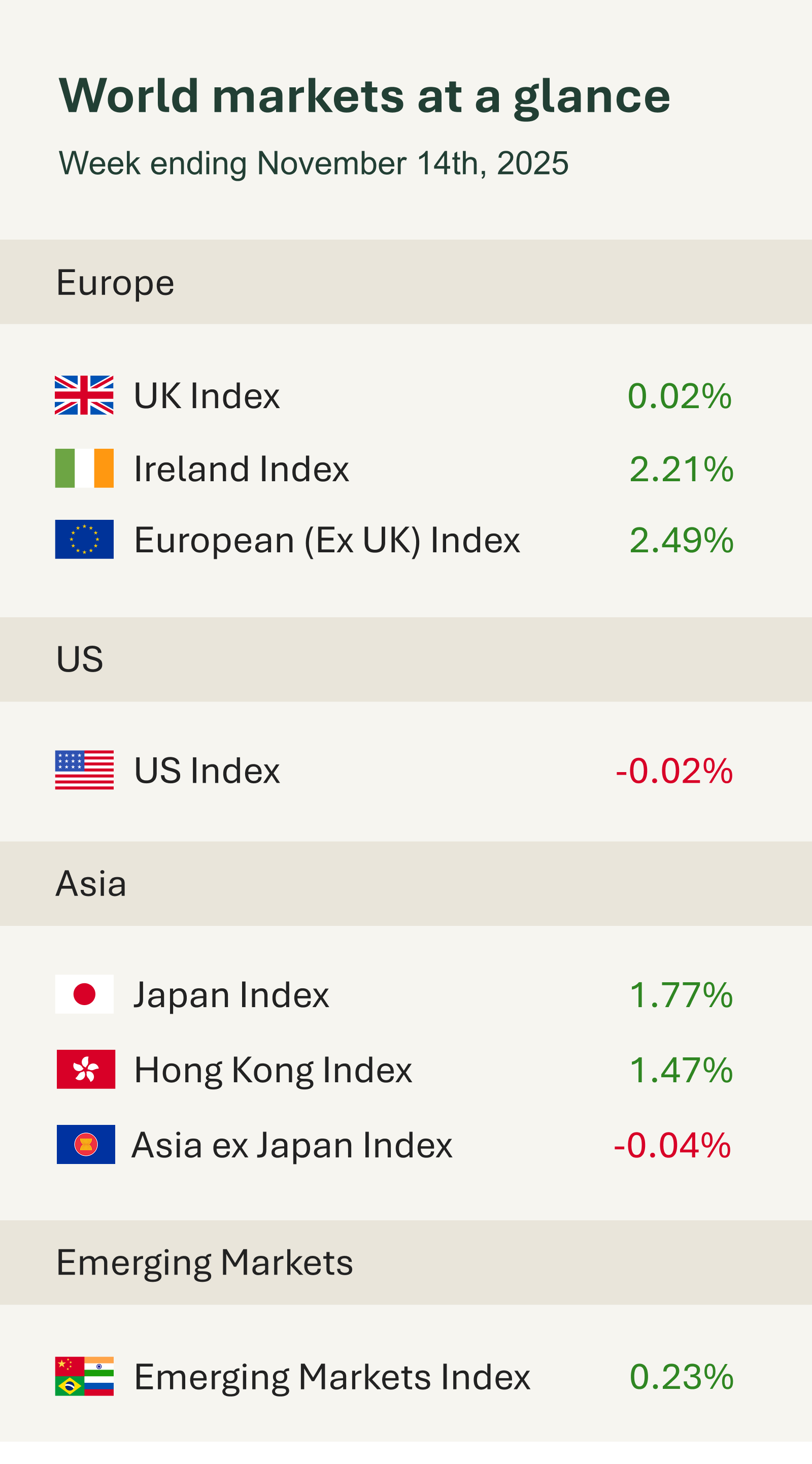

As shown in the accompanying table, financial markets mostly closed the week higher. They started on firmer ground after last week’s volatility, which was driven by the prolonged U.S. government shutdown and concerns over stretched big-tech valuations. Sentiment improved early in the week as weekend developments signalled the shutdown’s end, prompting a rotation back into large-cap tech after the prior risk-off tone.

President Trump signed a bill late Wednesday to end the longest shutdown in U.S. history. The legislation passed the House of Representatives by 222 to 209, with bipartisan support from six Democrats. The closure lasted 43 days, during which many federal agencies were unable to operate fully, and thousands of government employees were furloughed or unpaid. The bill provides funding only until 30th January 2026, making it a temporary stopgap rather than a lasting solution. Uncertainty persists ahead of further negotiations on enhanced healthcare insurance due to expire at year-end, an issue that could trigger another shutdown in February 2026 if not resolved.

The shutdown has disrupted key releases, October inflation and payrolls are unlikely to be published, and September jobs data remains outstanding. November figures will arrive just before the Fed’s 9–10 December meeting, complicating policy decisions. While some reports may not be recoverable, the reopening should gradually restore data flow, and policymakers will continue to weigh labour-market trends and inflation before deciding next steps. Markets now see less than a 50% chance of a December Fed rate cut, following comments from officials stressing resilience in the economy and lingering inflation concerns.

In the UK, markets initially reacted positively to softer wage growth and a modest uptick in unemployment data that suggested inflationary pressures may be easing, potentially giving the Bank of England greater scope to reduce interest rates. However, sentiment weakened following the release of Q3 GDP, which showed the economy expanding by just 0.1%, down from 0.3% in Q2 and below the 0.2% expected. This was driven by increases in services and construction – but there was a fall in the production sector.

Overall, industrial production fell 2% month-on-month the steepest drop since January 2021. Car production saw a sharp decline in September following a major cyberattack on Jaguar Land Rover (JLR). Motor vehicle and trailer output plunged 28.6% due to a full-month shutdown at JLR and related supply chain disruption. The attack at the end of August forced JLR to halt operations for over a month, pushing UK car production to a 70-year low for September. This skewed the data, and recovery will take time as lost output is made up.