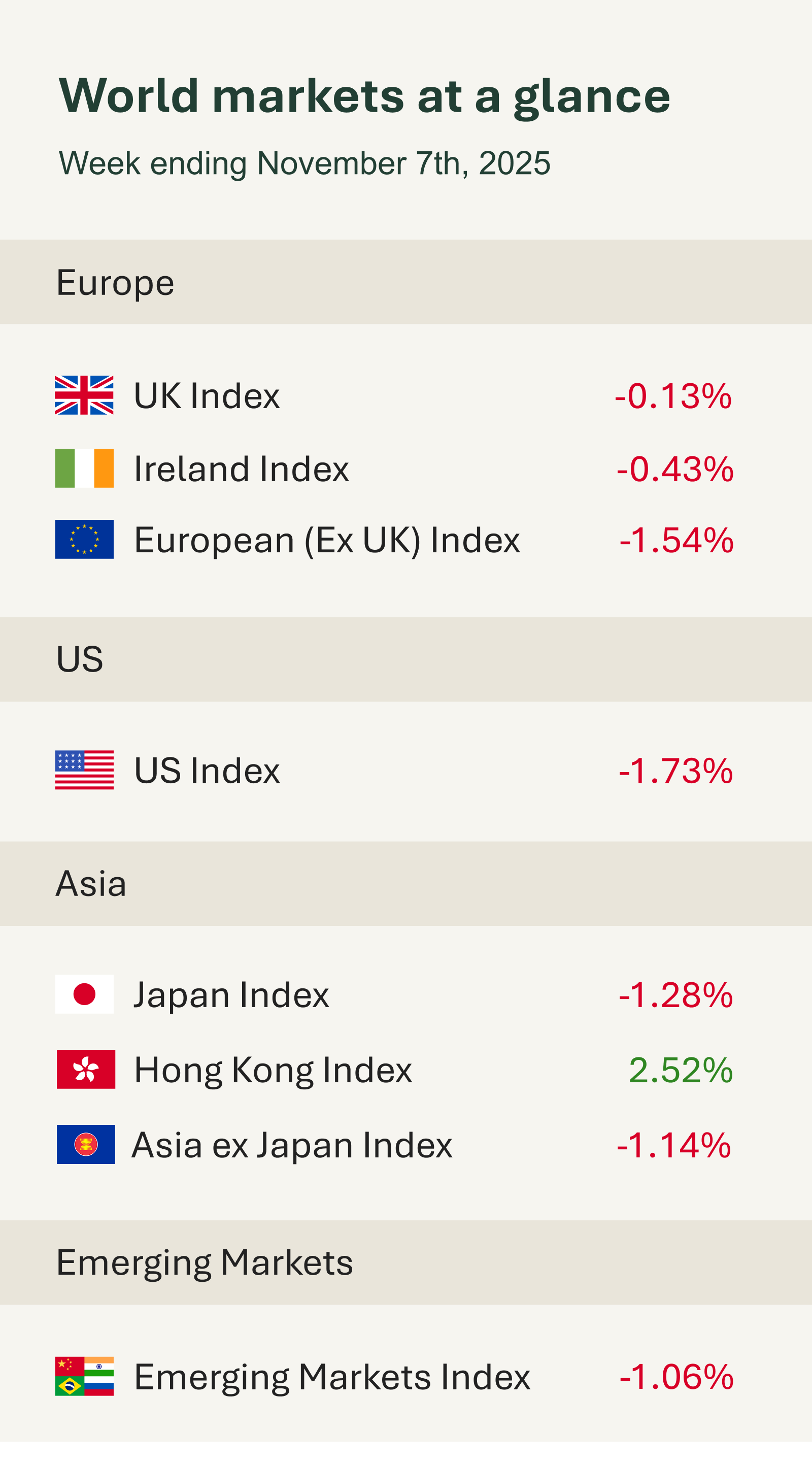

As you can see from the accompanying table, global equity markets experienced a softer week, with most major indices heading toward modest losses. Market sentiment was unsettled early in the week by renewed discussion around technology valuations and lingering uncertainty over the government shutdown in Washington. Investors also monitored developments at the U.S. Supreme Court, where justices appeared sceptical about the legality of prior trade tariffs, a ruling that could lead to tariff relief and improved trade dynamics.

This week, investors weighed whether the recent pullback in equities signalled routine profit-taking, a healthy reset after a strong rally, or the beginning of a more pronounced decline. While concerns around an “AI bubble” have surfaced, it’s important to contextualise these fears: in sterling terms the S&P 500 remains up 9% year-to-date and 33% from its April low following President Trump’s “Liberation Day” tariffs, reflecting broad market strength.

While valuations in parts of big tech are elevated, today’s leading AI and digital infrastructure companies are fundamentally different from those of past speculative cycles such as the dot-com bubbleThese firms are profitable, cash-generative, and serve real, growing demand. Their strong balance sheets and sustainable cash flows suggest that recent market action is more likely a recalibration than the start of a deeper correction. Short-term fluctuations are a natural part of any market cycle, and this week’s movement appears to be a period of consolidation following robust gains. Encouragingly, Q3 earnings have been strong: 91% of S&P 500 companies have reported, with 82% beating earnings and 77% exceeding revenue forecasts.

Given the global integration and reliance on technology and AI, the long-term outlook for these sectors remains strong and encouragingly, US futures are in the green as investors look set to re-enter the market on Monday.

Up until this week, the ongoing government shutdown had caused minimal disruption to markets. However, as it reached a historic milestone becoming the longest in U.S. history it began to draw headlines and stir investor sentiment. The week saw thousands of flight cancellations and delays due to air traffic control staffing issues, a continued blackout of key economic data releases, and disruptions to federal services.

Encouragingly, progress emerged over the weekend as senators reached a bipartisan agreement that could end the 40-day shutdown next week. While the deal still awaits House approval, it represents a constructive step forward and is likely to be viewed positively by markets.

In the UK, equities held up relatively well. The Bank of England voted 5–4 to hold rates at 4%, with the narrow decision and softer tone suggesting that rate cuts could begin as early as December.