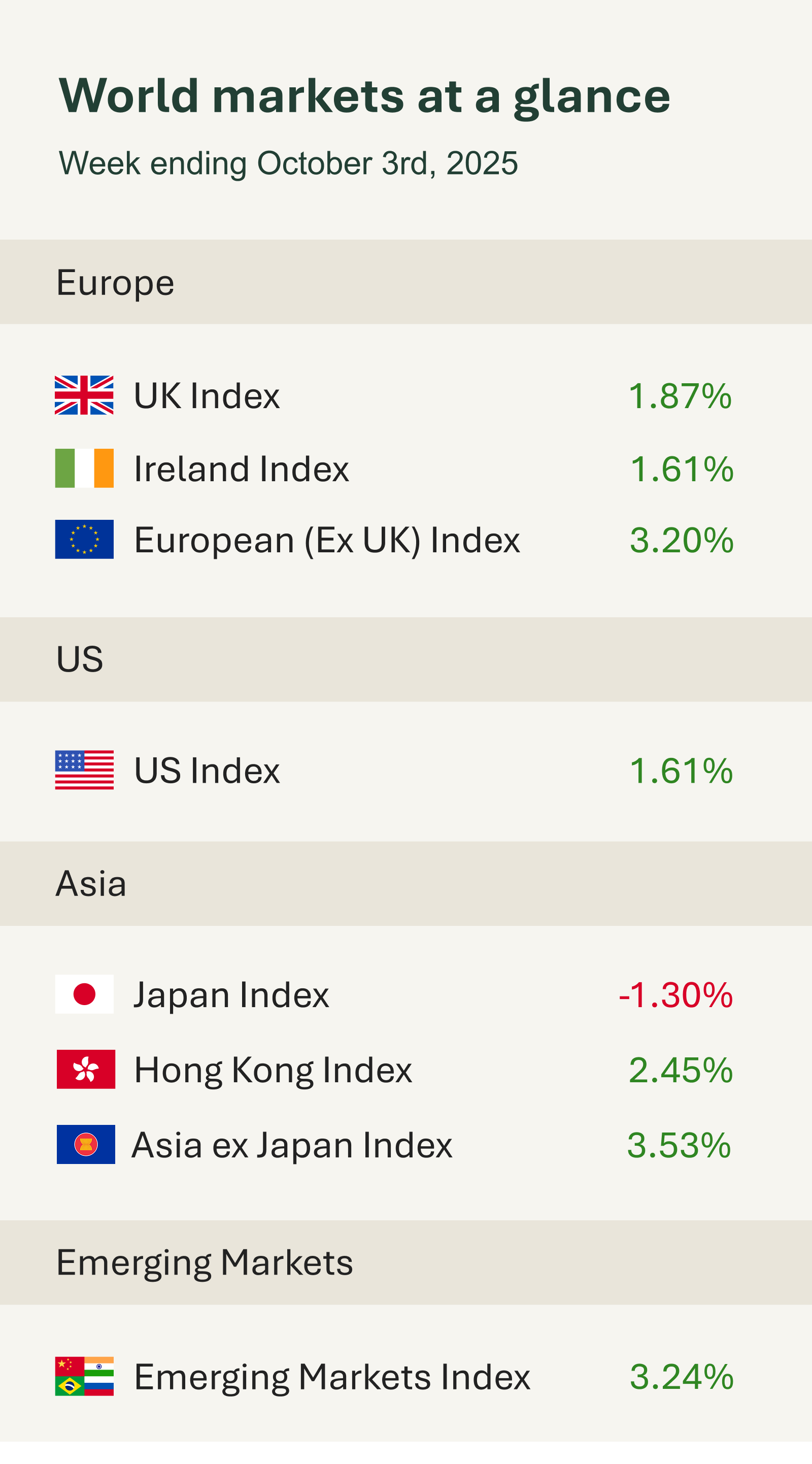

As you can see from the accompanying table it was a broadly positive week for global financial markets, as investors looked past political gridlock in Washington and instead rode a wave of optimism surrounding artificial intelligence and technology stocks.

Despite the U.S. government shutdown triggered by the Republicans and Democrats failing to agree on new spending plans markets remained remarkably steady. Historically, shutdowns have caused only limited long-term disruption, and this time proved no different. President Trump’s escalating rhetoric, including threats to lay off federal workers and slash state funding, did little to rattle sentiment.

The timing, however, was less than ideal. The shutdown has delayed key economic data releases, including Friday’s all-important September jobs report, leaving Federal Reserve policymakers without fresh labour market insights ahead of their October rate decision. Markets focused on alternative labour market indicators. These included the September private payroll data, which showed the economy losing 32,000 jobs. Consensus expectations had been for 51,000 jobs added, so the weakness seemed to increase market conviction in fed rate cuts to come. The Fed has already hinted that further weakening of the jobs market could influence the pace of its recently resumed rate-cutting cycle.

UK and European equities notched fresh record highs, buoyed by strong performances from chipmakers and AI-linked firms. Data wise Eurozone inflation rose to 2.2% on year in September, driven by services and energy, while core inflation held at 2.3% for the fifth month. The data supports the ECB’s decision to keep rates steady, as the increase was expected and doesn’t suggest accelerating price pressures.

The standout story of the week was OpenAI’s headline grabbing $6.6 billion share sale, which valued the company at around $500 billion, nearly double the figure reported earlier this year. The announcement ignited a global rally in AI and semiconductor stocks, underscoring the market’s unrelenting enthusiasm for the sector. Tech-heavy indices in both the U.S. and Europe surged, helping push the Stoxx 600 and Nasdaq higher for the week.

Over the weekend, Japan braced for a leadership transition following the resignation of Prime Minister Ishiba, who stepped down after a series of electoral setbacks. In a historic move, the ruling conservative party elected Sanae Takaichi as its new leader, positioning the 64-year-old to become Japan’s first female prime minister. Financial markets are now closely watching to see whether she will advance long-anticipated economic reforms.