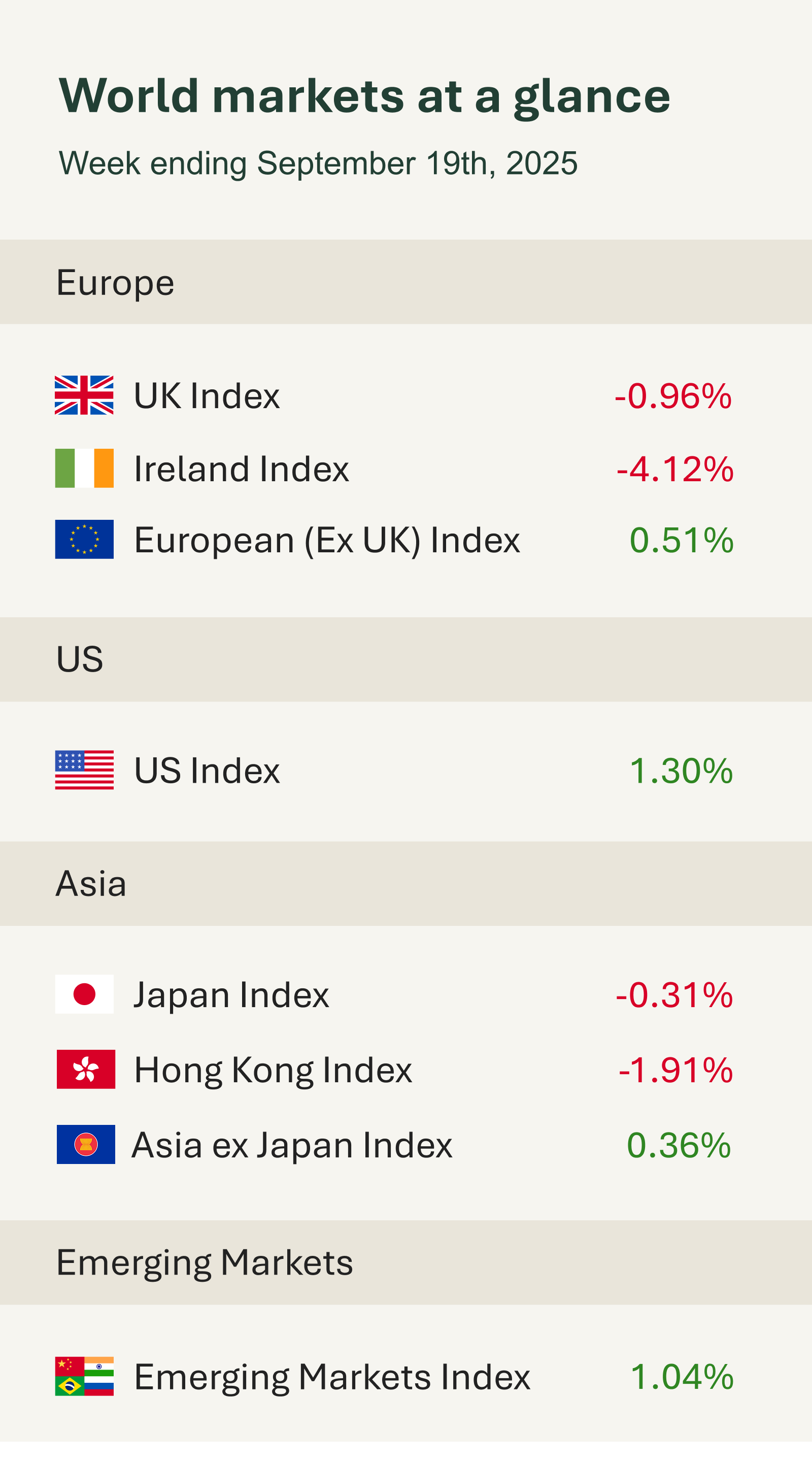

Markets ended the week mixed across regions, with US equities advancing to record highs, UK indices drifting lower, and Chinese benchmarks weakening as fresh economic data shaped expectations for monetary policy.

US stocks reached new records this week after the Federal Reserve resumed interest rate cuts and signalled that further reductions may be forthcoming. Policymakers lowered rates by 25bps on Wednesday, bringing the target range down to 4.00–4.25%. This marks the first cut since December 2024 and signals a shift towards looser policy amid signs of labour market weakness. While inflation remains elevated at 2.9% year-on-year, the Fed judged that slowing job creation and even a rare loss in June posed greater near-term risks.

Chair Jerome Powell tempered expectations of an aggressive easing cycle, stressing the Fed is “not on a pre-set path”, acknowledging downside risks in employment but pushing back on expectations for rapid cuts. He noted that tariffs are lifting some prices, while tight immigration has constrained labour supply. On housing, he downplayed the impact of a single cut.

The dot plot visually illustrates where the Fed’s senior policymakers expect the federal funds rate to move in the future. There was growing disparity among policymakers, with some favouring one rate cut this year and others expecting two. Going forward, markets will weigh the Fed’s data-driven stance against political pressure for deeper easing, with attention firmly on upcoming jobs reports and inflation trends.

In the UK, the Bank of England opted to hold interest rates at 4% on Thursday, reinforcing its cautious stance amid persistent inflationary pressures. The decision follows August’s razor-thin 5–4 vote to cut rates, which has now shifted to a firmer 7–2 majority in favour of maintaining the current level, with two votes for a 0.25% cut.

Headline inflation remains stubborn at 3.8%, driven by rising services and food prices. Policymakers expect inflation to rise slightly in the short term before easing in 2026, but the path to the 2% target is uncertain. Governor Bailey emphasised a “gradual and careful” approach to rate cuts, warning the UK is “not out of the woods yet”. Further cuts depend on clearer signs of disinflation and a cooling labour market.