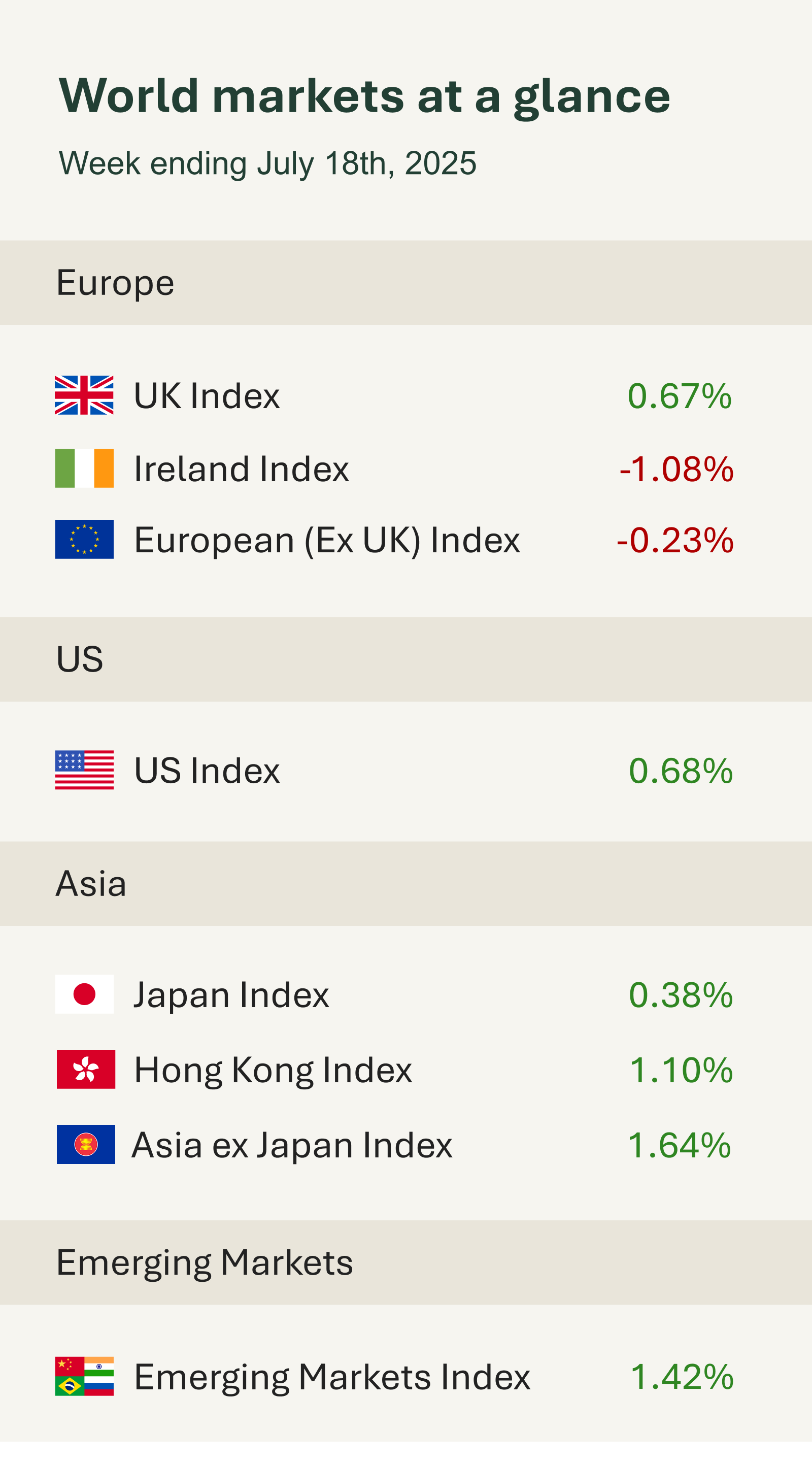

As shown in the accompanying table, global financial markets had a broadly positive week, although European markets lagged behind their international peers. It was a busy week economic data wise and thankfully unwanted surprises were at a minimum whilst strong corporate earnings, steady consumer spending all helped keep investor sentiment buoyant.

U.S. equity markets climbed to fresh highs, with the S&P 500 and Nasdaq Composite both setting new records. The rally was supported by better-than-expected second-quarter earnings from major U.S. companies, suggesting that corporate fundamentals remain solid despite concerns about inflation and rates. Large banks including JP Morgan Chase and Citigroup surprised to the upside, indicating continued resilience in the financial sector. Strong results from consumer-facing firms like PepsiCo, United Airlines and Netflix pointed to healthy demand and stable margins. The high beat rate is notable given that expectations had been scaled back in recent months, leaving room for companies to outperform.

U.S. economic data painted a mixed picture this week with inflation figures stable and the consumer still spending. We saw some noise surrounding Donald Trump, with speculation swirling over Federal Reserve Chair Jerome Powell’s future, with reports that Donald Trump had drafted a dismissal letter – a move he later downplayed.

U.S. retail sales rose a better-than-expected 0.6% in June, offering reassurance about the resilience of the consumer. The gains were broad-based, led by autos and discretionary spending. The report tempered concerns about a slowdown in household demand, even as inflation pressures persist.

U.S. producer price inflation, a precursor of the CPI, was flat month-on-month, and the annual core rate fell to 2.6%. Applications for unemployment benefits dropped again, signalling continued labour market strength. Markets responded positively, with high tariffs seemingly not yet filtering through into economic data.

In the UK fresh data showed the labour market continues to weaken. The unemployment rate rose to 4.7% in the March–May quarter, up from 4.5% previously and above expectations. Vacancies also declined by 56,000, and wage growth slowed to 5.0%, down from 5.3% the prior months. With inflation rising to 3.6%, the cost-of-living squeeze has intensified.

The softer labour data has reinforced expectations that the Bank of England policymakers may feel comfortable cutting interest rates from 4.25% to 4.00% at its next meeting. Governor Andrew Bailey earlier signalled that a weaker labour market could justify a more aggressive easing path. However, the data wasn’t as weak as anticipated, and the Bank remains cautious, noting the persistence of underlying inflation and mixed pay trends.