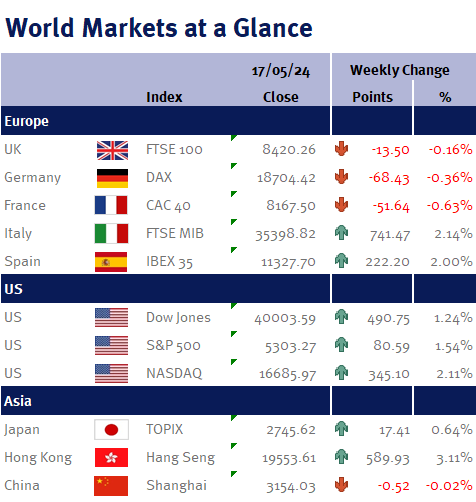

This week, financial markets were focused on the latest US consumer price data. After previous readings came in hotter than expected in recent months, Thursday’s report bucked the trend, allowing investors to breathe a sigh of relief. April’s inflation figures revealed a modest rise of 0.3%, falling short of the anticipated 0.4%, while core inflation (excluding food and energy) rose by 0.3% as expected. On an annual basis, prices rose by 3.4%, matching forecasts and slightly below the previous month’s 3.5% rate. This data reinforced the notion that inflation is on a downward trend, albeit a bumpy one, paving the way for potential rate cuts by the Fed. It seems like the Fed’s aim for a “soft landing” for the economy might just be within reach.

The Consumer Price Index (CPI) report’s indication of easing inflation has strengthened the belief that the Federal Reserve might initiate an interest rate cut by September. The prospect of a more accommodative monetary policy led global stock markets to soar to record highs. This sentiment was further supported by Wednesday’s retail sales data, which showed an unexpected stagnation in April. The data indicated that consumers were reducing their discretionary spending. Sales at primarily online retailers declined, whereas sales at restaurants and bars continued to slow.