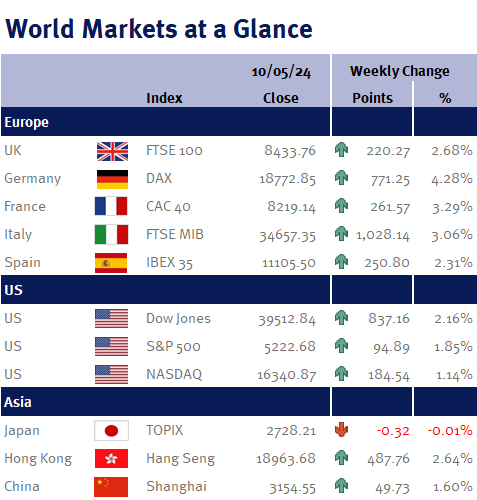

As you can see from the accompanying table markets broadly closed the week higher.

The FTSE 100 soared closing the week up 2.68%. The Bank of England held its ground on Thursday, opting to hold interest rates at 5.25%, a decision that came as no surprise to market participants. Governor Andrew Bailey struck a tone of cautious optimism, citing encouraging developments in inflation and predicting it to fall to the 2% target in the coming months. His remarks were well-received by the markets, signalling a potential shift in the hawkish sentiment. Despite holding rates steady, the committee’s stance hinted at a more dovish tone, with 7 members voting to maintain rates and 2 advocating for a cut.

Looking ahead to the next meeting in June, policymakers will closely analyse labour market reports and inflation figures to gauge the economy’s trajectory. Governor Bailey emphasised that while a rate change in June is not predetermined, it remains a possibility depending on economic indicators.