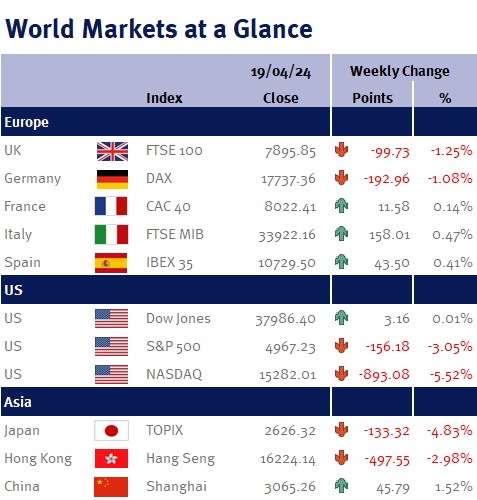

Financial markets embarked on a roller coaster ride this week, navigating through geopolitical tensions and interest rate uncertainties. Stocks retreated from their highs as investors grappled with escalating tensions between Israel and Iran, prompting a cautious stance across the board.

Tensions in the Middle East have caused volatility in the markets, especially in commodities like oil. Reports of explosions in an Iranian city on Friday, purportedly due to an Israeli attack, initially rattled markets. However, Iran’s measured response, indicating no immediate plans for retaliation, eased fears of immediate escalation, albeit leaving some uncertainty about the situation’s real impact. As always, our investment management team will continue to monitor developments closely, conscious of potential downside risks while also ready to capitalise on short-term opportunities.

US stocks retreated as investors adopted a more cautious stance amidst Middle East tensions and adjustments to interest rate expectations. In addition to hearing from Federal Reserve Chair Jay Powell this week, other Fed officials signalled a patient approach to interest rate adjustments. Recent economic data prompted officials to express caution, with concerns over the timing of potential rate adjustments influencing market sentiment.