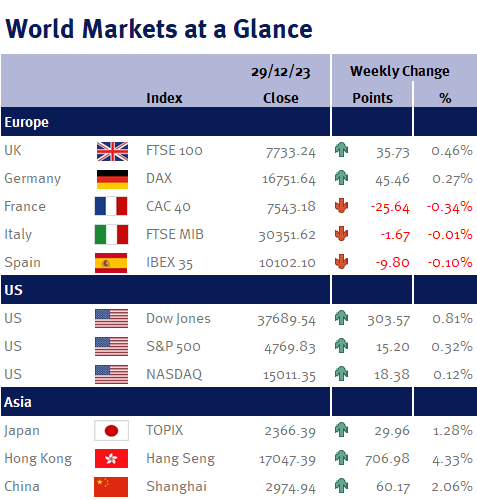

With traders returning from an extended Christmas break and only a few days remaining in the year, markets extended their “Santa Rally” during the final trading days of 2023. Global markets surged since mid-December following major central bank pauses in monetary tightening with the Federal Reserve hinting at potential rate cuts in 2024, boosting investor sentiment.

It was a quiet week for markets, with a scarcity of economic data for investors to digest. The S&P 500 hovered around its all-time high last week. Initial jobless claims rose by 12,000 to 218,000 last week, surpassing consensus expectations of 210,000. Despite the increase, first-time applications for unemployment benefits remained near historical lows, providing further evidence that companies are hesitant to reduce headcounts amid steady demand. Treasury yields also continued to decline, reflecting hopes that inflation has cooled enough for the Federal Reserve to consider rate cuts.