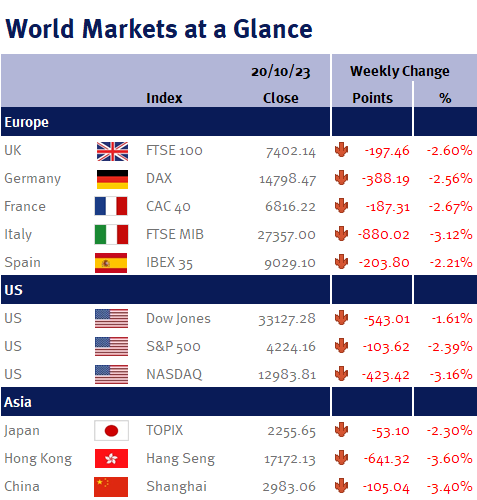

As demonstrated by the accompanying table, this week presented notable challenges for markets driven by geopolitical tensions that served to both elevate and dampen investor sentiment. Fears arising from the escalation of geopolitical tensions in Gaza have intensified concerns about potential disruptions in oil supplies, adding to expectations that interest rates may need to stay elevated for an extended period.

It’s worth noting that our experienced investment management team is well-equipped to skilfully navigate this landscape. The team excel in identifying investment opportunities, ensuring portfolios are well-positioned as the global financial landscape navigates uncharted waters.

Chairman of the Federal Reserve Jerome Powell’s speech before the Economic Club of New York offered insights into the current economic climate. Powell’s remarks significantly influenced the financial landscape, propelling the 10-year U.S. Treasury yield to cross 5% for the first time since 2007. Powell emphasized key factors of importance to market participants, with inflation taking the spotlight. Although short-term core inflation measures have recently eased, it’s essential to recognize that inflation remains elevated. He noted that failing to act decisively could lead to persistent inflation entrenchment, requiring more drastic monetary policy. Labour market dynamics were another key aspect, with various indicators suggesting a gradual cooling while wage growth moves closer to the Federal Reserve’s 2% inflation target.