In addition, the annual GDP growth rate of US economy was revised to 2.1%, down from the initial estimate of 2.4%. This adjustment led to a rise in stock prices, as it might provide the Federal Reserve with additional reasons to pause interest rates unchanged at its upcoming meeting.

The recent reports align favourably with the Fed’s objectives, with signs of a weakening labour market. These trends have further bolstered expectations that policymakers will opt to maintain current interest rates at the upcoming meeting this month.

Looking elsewhere, as of late China’s economic data has disappointed investors, but there were signs of improvement in this week’s PMI data. The Caixin Manufacturing PMI surged to 51.0, exceeding expectations of 49.3 and reaching its highest level since February 2023, indicating expansion.

The People’s Bank of China also made notable monetary policy announcements on Friday. They plan to reduce the foreign exchange reserve requirement ratio for financial institutions by 200 basis points from 15 September, aiming to stimulate economic growth and boost financial system liquidity. Several Chinese banks announced interest rate cuts on yuan deposits, which is likely to promote lending and borrowing within the domestic market.

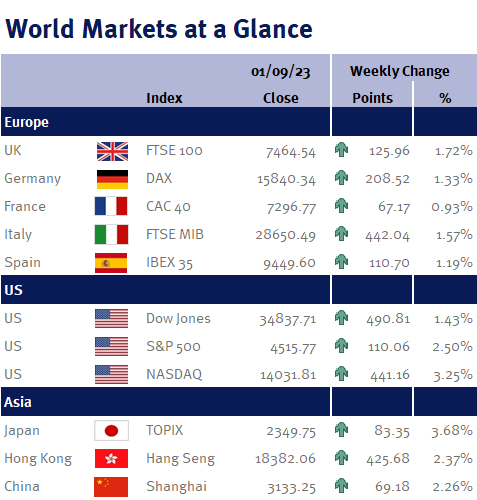

Both the Shanghai Composite Index and the Hang Seng in Hong Kong witnessed gains, although markets closed early due to an approaching typhoon. These moves highlight the central bank’s efforts to adjust monetary policy to support economic growth and liquidity, addressing economic challenges and fostering potential economic activity.

In August, Europe’s annual inflation rate held steady at 5.3%, which was slightly higher than the expected 5.1%. However, there was a reassuring development for the European Central Bank (ECB) as the core inflation rate decreased from 5.5% to 5.3%. This mixed data hasn’t settled the debate within the ECB, but it did lead investors to lower their expectations of a September interest rate hike. Those advocating for a pause in tightening monetary policy argue that economic growth is deteriorating rapidly, and there’s a risk of the Eurozone slipping into a recession, given the lack of factors to stimulate a rebound.

Coming up next week we have Chinese services PMI and trade data. US factory orders, balance of trade and initial jobless claims. We also have UK retail sales and preliminary Eurozone GDP data.

Kate Mimnagh, Portfolio Economist