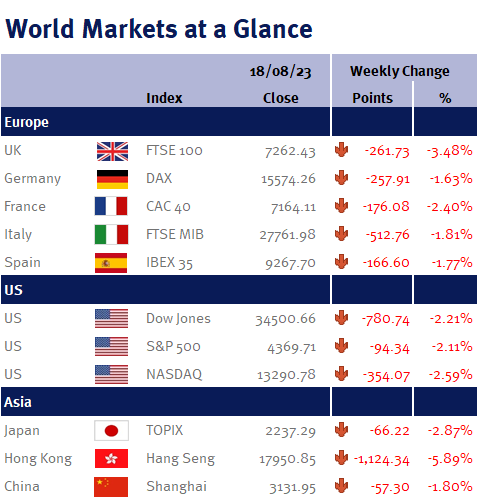

Markets ended the week lower.

On Wednesday (16 August), the minutes from the US Federal Reserve’s late July meeting disclosed a divergence amongst policymakers regarding the necessity of further rate hikes. While some participants cautioned against the potential negative economic consequences of excessive rate increases, others stressed the ongoing importance of tackling inflation, implying the potential for additional rate hikes. Many believe that the Fed has most likely finished its tightening cycle, however policymakers haven’t strayed from their data-dependent stance and could potentially hike rates again if the data supports.

Retail sales in July took centre stage, revealing an impressive 0.7% month-over-month surge, surpassing consensus estimates of 0.4%. Sales were boosted by online shopping, specifically Amazon Prime day in addition to people splurging on hobbies and sporting goods. The report underscored the resilience of consumers in the face of higher interest rates adding to hopes of a soft landing.