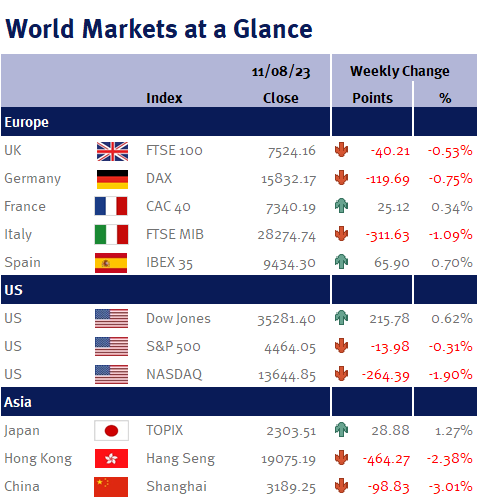

As you can see from the accompanying table markets ended the week mostly lower as stocks managed to recover some ground as the week unfolded.

Investors focussed on US inflation data, with the consumer price index rising 0.2% in July 2023, contributing to a 3.2% year-on-year increase. The latest report seemed to have been largely incorporated into market expectations, resulting in a subdued response. Whilst the consumer price index came in below economist forecasts in July, suggesting a continued drop in inflation, the producer price index exceeded expectations but indicated most prices were lower than the previous year. Despite this mixed data, investors anticipate the Federal Reserve will pause interest rate hikes in September.

The Federal Reserve is likely to maintain its current stance for the time being, which means potential rate hikes remain on the table, the Fed is expected to communicate this consistently. However, the certainty of ending rate hikes is unclear, as the Fed awaits the August CPI and jobs report to make informed decisions.