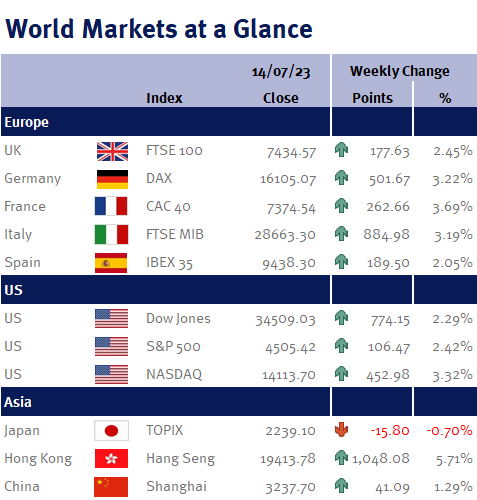

As shown in the accompanying table, markets experienced gains this week as investors responded positively to further signs of cooling inflation in the US. The prevailing sentiment reflected optimism regarding the economic outlook.

A report this week from the University of Michigan showed a significant increase in US consumer sentiment, further reinforcing positive economic expectations. In June 2023, the US’ annual inflation rate dropped to 3%, the lowest since March 2021 and below market forecasts of 3.1%. This slowdown can be attributed to a high base effect from the previous year (the method by which inflation is measured) when energy and food prices surged meant inflation reached highs of 9.1%. Energy costs specifically declined by 16.7% compared to May. While the rising cost of goods and services in the US has slowed to a two-year low, core inflation – excluding energy and food sectors – remains slightly higher. However, June saw the lowest core inflation rate since 2021, indicating a cooling of prices.

Latest data advanced markets this week with hopes that the central bank is nearing the end of its rapid rate rise cycle. US Policymakers are expected to raise interest rates by a quarter point at their upcoming meeting in July.