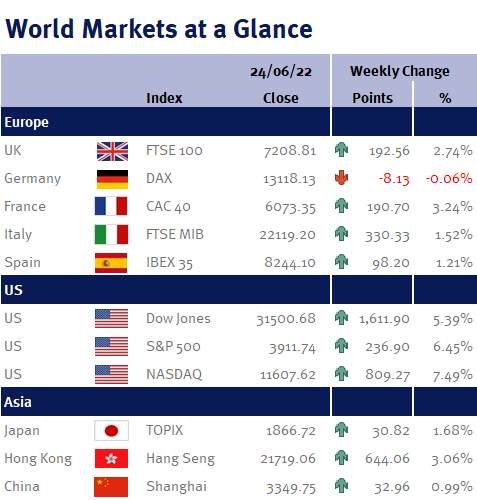

Global equity markets rose this week due to falling inflation expectations – which hopefully means that central bank policymakers will scale back their expected aggressive interest rate increases.

This week’s PMI data came in well below expectations – confirming our recent comments that the global economy was slowing. For example, US Manufacturing PMI came in at 52.4 for June. While it is positive that the reading was above 50 (50 is the line separating expansion and contraction – so US manufacturing is still expanding), this was a big drop from May’s reading of 57.0 and was well below economists’ expectations of 56.0.

Although it was a similar story in Germany’s manufacturing based economy, as the manufacturing PMI reading fell from 54.8 to 52.0 (well below expectations of 54.0), the accompanying statement stated that prices for both goods and services rose at a slower rate in June compared with May – which hopefully suggests that we may be starting to reach peak inflation.