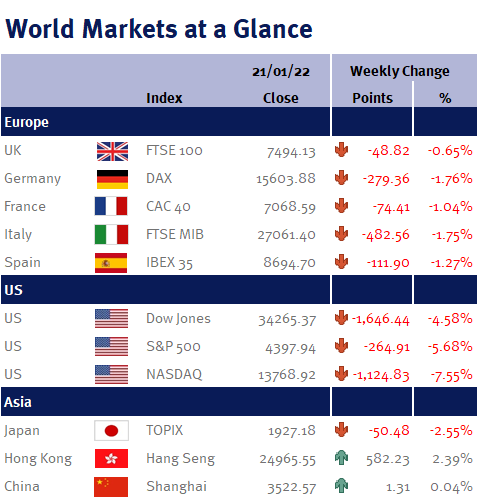

Although our portfolios were by no means immune from these painful falls, the benefits of our disciplined approach to diversifying portfolios across a variety of assets and geographies was evident, as UK & European equity markets were fairly well insulated from much of this week’s bearishness given their composition is more skewed to value companies as opposed to technology (not to mention that the UK equity market is historically cheap and offers an attractive dividend yield relative to many other markets, particularly the US), while Chinese equity markets actually ended the week higher after their central bank, the PBOC, cut interest rates.

Geopolitical concerns also weighed heavily on equity markets as the escalating US standoff with Russia over Ukraine added to the uncertainty caused by North Korea’s recent missile tests; Iran’s nuclear program; Yemen’s drone attack on UAE; and forthcoming elections in South Korea (Wednesday 9 March).

Unfortunately, the path for equity markets is never smooth or easy and we fully expect equity markets will remain volatile until we have geopolitical transparency and clarity from the Fed (we believe that current market estimates of four interest rate increases starting with a 0.5% increase in March is well wide of the mark as we believe recent economic data suggests that US economic growth is starting to slow).

Looking ahead to the coming week, we have the first Fed monetary policy meeting of the year (and we will be looking for clues on the policymakers’ current views on the trajectory and speed of US interest rate increases) as well as the central bank’s preferred inflation measure, the PCE (while we expect a higher year-on-year reading, we are hoping to see the month-on-month reading slow).

Elsewhere we have US, UK, Eurozone & Japanese PMI; US housing data; US durable goods orders; and US Q4 GDP. Additionally, we could see the publication of Sue Gray’s investigation into all of Downing Street’s lockdown parties.

The Investment Management Team