Data this week showed that the US was living with the fastest inflation in nearly 40 years (since June 1982 to be precise) at 7.0%.

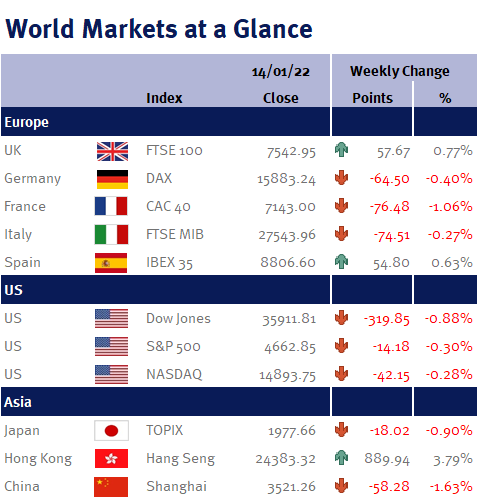

Week ending 14th January 2022.

17th January 2022

And after last week’s (please see here) very hawkish Fed minutes, this inflation reading increased market speculation that the Fed will start to increase US interest rates in March, followed by a further three increases before the end of the year!

However, we found it interesting that Jay Powell, the Fed Chair, attempted to soothe concerns that the Fed will hurt the economic recovery by being too aggressive with their increases, saying at his nomination hearing earlier in the week, that while he wanted to ensure inflation doesn’t become entrenched he would protect the economy in order to support the employment market.

This is very pleasing as today’s data (14 January 2022) showed that US retail sales declined 1.9% during December, while the University of Michigan consumer sentiment index showed lower current and expected confidence. This coupled with Wednesday’s (12 January 2022) Beige Book which downgraded its view of the economic recovery to ‘modest’ from ‘moderate’, suggesting that the US economic recovery could be starting to slow – and this will hopefully be enough to convince the Fed’s policymakers not to get carried away with interest rates increases, especially as we believe inflation will start to ease in the coming months as supply-chain disruptions and bottlenecks dissipate.

Looking ahead to the week coming, despite the US markets being closed on Monday (17 January 2022) for the Martin Luther King holiday, we have lots of key data releases including the Empire State manufacturing survey; UK employment data (unemployment rate and weekly earnings); UK, Eurozone and Japanese CPI inflation; UK and Chinese retail sales; Chinese industrial production; US housing data; Chinese Q4 GDP; and the Philadelphia Fed business outlook survey.

The Investment Management Team

The latest market updates are brought to you by Investment Managers & Analysts at Wealth at Work Limited which is a member of the Wealth at Work group of companies.

Links to websites external to those of Wealth at Work Limited (also referred to here as 'we', 'us', 'our' 'ours') will usually contain some content that is not written by us and over which we have no authority and which we do not endorse. Any hyperlinks or references to third party websites are provided for your convenience only. Therefore please be aware that we do not accept responsibility for the content of any third party site(s) except content that is specifically attributed to us or our employees and where we are the authors of such content. Further, we accept no responsibility for any malicious codes (or their consequences) of external sites. Nor do we endorse any organisation or publication to which we link and make no representations about them.