The week started on a negative footing as energy prices rose (which focused the market on its impact on inflation and interest rates), while the US inched towards default.

Thankfully the big jump in gas prices has started to reverse, helped by comments from the Russian President, Vladimir Putin, who said that Russia could increase exports of natural gas to Europe, while the rise in the oil price was halted by the US Energy Secretary, Jennifer Granholm, after she said that she was considering releasing oil from the US strategic petroleum reserve.

Additionally, sentiment was helped after Mitch McConnell, the Senate Republican Leader, agreed to a short-term debt ceiling extension, in order to avoid a US government default.

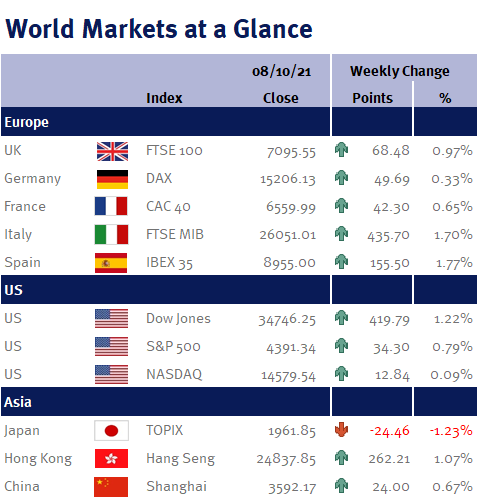

Consequently, global equity markets reversed their earlier losses, to end the week in a positive territory.

Even though these developments are all positive for global equity markets (especially as it illustrates that equity markets are capable of surviving scares by climbing several “walls of worry”), the path for financial markets is never smooth and unfortunately we expect this elevated equity market volatility will remain with us over the next few months.