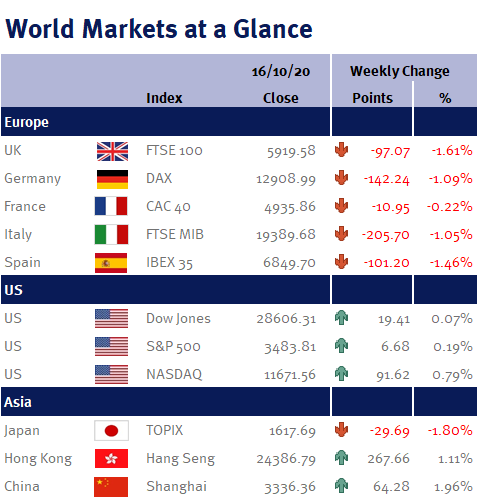

The cacophony of noise from the resurgence in coronavirus cases and the US election may be deafening, but as you can see from the accompanying table, it hasn’t stopped global equity markets rising strongly over the week.

As we stated in our mid-week update on Wednesday (7 October 2020 – please see here), while Donald Trump’s tweet, late on Tuesday (6 October 2020), saying he was stopping stimulus negotiations until after the US Presidential election was disappointing and sent equity markets lower, we didn’t believe that it really changed much. Pre-election stimulus was already looking very unlikely, but ultimately stimulus will be provided after the election to help those American households and businesses that have been hard-hit by the coronavirus outbreak and associated lockdowns, whoever wins the Presidency.

Thankfully, it wasn’t just us that was able to look beyond this initial disappointment as the resulting sell-off proved very short-lived.

Although the US Presidential election currently feels more like a referendum on Donald Trump, rather than a typical choice between a Republican (Donald Trump) and a Democrat (Joe Biden), equity market sentiment was also helped by polls showing Joe Biden’s lead over Donald Trump was increasing.

While it is an open question what a victory for either Donald Trump or Joe Biden would mean for equity markets in the long-term, in the short-term a Democrat victory is likely to result in an even bigger fiscal stimulus package, than the $2tr+ package that was being negotiated.

Sentiment was also helped by the weekly US jobless claims data which showed that continuing claims fell by an impressive 1m to 11m. Continuing claims reflects the total number of Americans claiming unemployment benefits – and at its peak in May, stood just shy of 25m. However, before the coronavirus outbreak continuing claims typically ran just below 2m, so with 11m Americans still claiming benefits there is clearly a long road ahead, but what we found particularly encouraging was the fact that this decline was large and broad-based across most US states.

Additionally, the release of the minutes from the last US Fed monetary policy meeting held on 16 September 2020, showed that the US central bank’s economic forecasts had been made on the assumption that there would be further significant fiscal stimulus provided during Q4 – which suggests to us that the Fed is now likely to aggressively support the economy with additional monetary policy stimulus.

In the UK, today’s (9 October 2020) 2.1% GDP growth reading for August may have made headlines because it slowed from 6.4% in July, it should be noted that not only is this data backward looking, but we knew that the pace of the economic rebound we saw in June and July was unsustainable, as the economy started reopening (and recovering) in mid-May.

Looking at the week ahead, we have UK employment data (unemployment rate and weekly earnings); US CPI inflation; US Empire State Manufacturing Survey; US retail sale; US jobless claims; University of Michigan Consumer Sentiment Index; and Chinese import/export data.

Investment Management Team