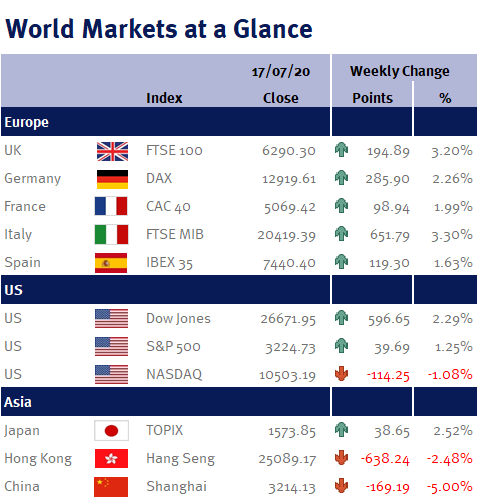

As you can see from the accompanying table, most of the major equity markets ended a relatively quiet week with a small gain.

Week ending 10th July 2020.

13th July 2020

This is impressive given the backdrop of increased tension between the US and China and a rise in coronavirus cases in America (the world’s largest economy), which obviously has the potential to slow the economic recovery from a ‘V’ shape to a ‘Nike Swoosh’ (i.e. still a strong recovery, just slightly slower).

The fact that equity markets can continue to rise amid the increase in coronavirus cases and during one of the sharpest and deepest economic downturns in history, reflects the disconnect that is opening up between the trajectories for coronavirus cases and deaths, coupled with the effectiveness of the unprecedented government and central bank stimulus.

Additionally, we had some positive test results from the potential new drug, Remdesivir. Data from a study covering 1,063 patients of different sexes, ages, and ethnic groups showed that the antiviral medication does reduce mortality and the length of sickness.

However, this doesn’t mean we aren’t concerned: the return to ‘normal’ is likely to be bumpy and taking two steps forward and one step back is unfortunately something we are now going to have to live with over the coming weeks and months.

Consequently, as we have previously explained, we like to invest with your long-term interests in mind by focusing on risk management and capital preservation, as we believe that this is just as important as investment performance and returns. Although the path of least resistance for equity markets is currently up, we aren’t oblivious to the current economic and political risks and as such, we are maintaining a defensive stance by holding a slightly higher than normal level of cash (including liquidity funds).

The main economic data release during the week was yesterday’s (Thursday 9 July 2020) weekly US jobless claims, which showed both the initial and continuing claims continued to decline (which is positive news).

We have a much busier week ahead: both the ECB and Bank of Canada have monetary policy meetings. Other highlights include: UK CPI inflation, GDP for May and employment data (unemployment rate and weekly earnings); US CPI inflation, retail sales, industrial production, the Fed’s Beige Book, and the University of Michigan Consumer Sentiment; Eurozone industrial production; and Chinese retail sales and industrial production.

However, the data releases that are most likely to impact equity market direction next week are the US Empire State Manufacturing Survey (on Wednesday 15 July 2020), followed by the Chinese Q2 GDP and the US weekly jobless data (both on Thursday 16 July 2020).

Investment Management Team

The latest market updates are brought to you by Investment Managers & Analysts at Wealth at Work Limited which is a member of the Wealth at Work group of companies.

Links to websites external to those of Wealth at Work Limited (also referred to here as 'we', 'us', 'our' 'ours') will usually contain some content that is not written by us and over which we have no authority and which we do not endorse. Any hyperlinks or references to third party websites are provided for your convenience only. Therefore please be aware that we do not accept responsibility for the content of any third party site(s) except content that is specifically attributed to us or our employees and where we are the authors of such content. Further, we accept no responsibility for any malicious codes (or their consequences) of external sites. Nor do we endorse any organisation or publication to which we link and make no representations about them.