Consequently, equity markets instead took comfort from Donald Trump’s guidelines for a phased/state-by-state economic reopening. Additionally, a number of European countries including Austria, Denmark, Italy, Spain and Germany, started taking baby-steps towards reopening their economies.

Although the US and the majority of Europe currently remains closed, as the end of the coronavirus lockdowns are clearly in sight, it is best to focus on the likely duration of the economic decline rather than the depth, as once the lockdowns are lifted, the global economy will quickly start to recover.

Additionally, given the expectations for miserable economic data and company earnings are already priced in, any green shoots are enough to spark optimism and therefore higher equity markets – and a key consumer stock, L’Oréal, this week said that once the lockdowns in China were lifted their sales quickly bounced back (please see here), which confirms our belief that the global economy will see a V-shaped economic hit and recovery.

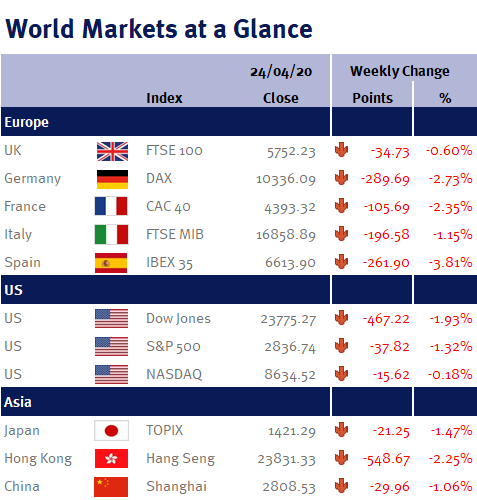

Although we aren’t claiming that everything will be back to normal in the coming weeks, these actions mean that we can now see light at the end of the tunnel. In the meantime, equity market volatility is likely to remain elevated, especially as more US companies report results this week (about half of the S&P 500 constituents are expected to release statements this month, so it is feasible we will see big swings in individual share prices as well as indices).

Data wise, this coming week in the UK we have employment data, CPI inflation and retail sales, while in the US the main attention will be on the weekly jobless claims and April PMI data.

Investment Management Team