Furthermore, a big clue came from Jay Powell when he spoke dovishly late this afternoon (Friday 23 August 2019) at the annual symposium of global central bankers in Jackson Hole. While he repeated that the US economy is in a good place, he didn’t repeat the phrase “mid-cycle adjustment” and moreover in acknowledging the risks to the growth outlook, he said that the Fed would “act as appropriate to sustain the [economic] expansion”.

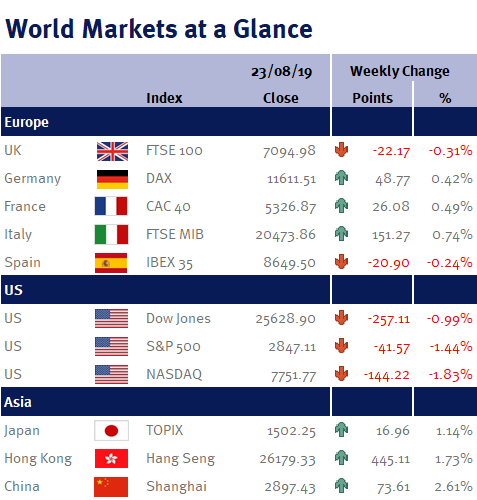

Unfortunately, this got overshadowed by China and a series of confrontational tweets from Donald Trump this afternoon. After China announced plans for additional tariffs on US goods totalling $75bn, Donald Trump immediately responded saying the US would also increase existing tariffs on Chinese goods. He also tweeted that the US didn’t need China and ordered US companies to leave China, which pushed global equity markets lower, reversing all the gains made earlier in the week.

This weekend we have the G7 summit in France. Additionally, this coming week we have the Fed’s preferred inflation gauge, the PCE; the second reading of US Q2 GDP; and Eurozone CPI.

Investment Management Team