Week ending 1st March 2019.

4th March 2019

As we speculated three weeks ago (please see here), Donald Trump this week said he would delay implementing US tariff increases planned for today (Friday 1 March 2019) as the US and China continue to progress their negotiations for a new trade deal.

The pound led the moves in the currency markets, jumping on a potential delay to Brexit.

While we understand that a Brexit delay is supportive for the pound (as it potentially reduces the threat of a no-deal Brexit), its strength looks more like the triumph of hope over experience as it doesn’t do anything to end the pantomime and uncertainty that is weighing on the UK economy as we don’t know what a delay leads to. The delay could simply push decision day back from the end of March to the end of June.

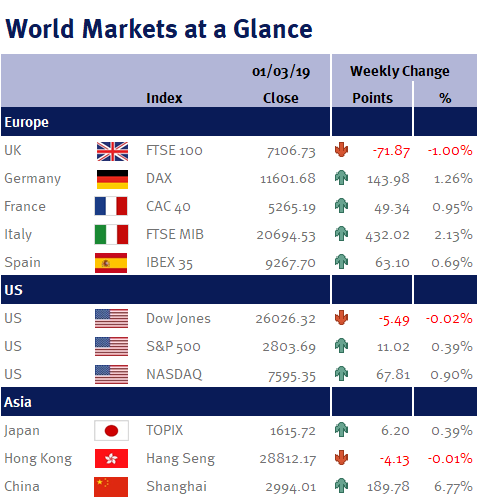

And remember, what is good for the pound is bad for the FTSE-100, as it lowers returns for exporters and the value of overseas earnings – hence why the FTSE-100 ended the week 1% lower.

Interestingly, if Theresa May can’t get MPs to approve her Brexit deal with the EU by Tuesday 12 March 2019, she will put the idea of a no-deal Brexit to Parliament the following day, Wednesday 13 March 2019 – which is also currently scheduled to be the date for the Chancellor of the Exchequer, Philip Hammond’s, Spring Statement. However, as it is not a full fiscal statement (and should therefore be reasonably short), we assume it could still go ahead – and anyway, moving it now would signal that the government is accepting Theresa May will lose her vote on the Tuesday!

Next week we have the Fed’s Beige Book; US employment data (non-farm payrolls; unemployment rate; the participation rate; and average earnings); and an ECB monetary policy meeting.

Investment Management Team

The latest market updates are brought to you by Investment Managers & Analysts at Wealth at Work Limited which is a member of the Wealth at Work group of companies.

Links to websites external to those of Wealth at Work Limited (also referred to here as 'we', 'us', 'our' 'ours') will usually contain some content that is not written by us and over which we have no authority and which we do not endorse. Any hyperlinks or references to third party websites are provided for your convenience only. Therefore please be aware that we do not accept responsibility for the content of any third party site(s) except content that is specifically attributed to us or our employees and where we are the authors of such content. Further, we accept no responsibility for any malicious codes (or their consequences) of external sites. Nor do we endorse any organisation or publication to which we link and make no representations about them.